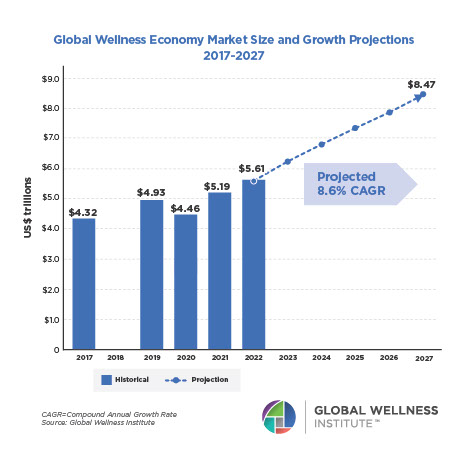

2023 Global Wellness Economy Monitor

Snapshots of the 11 Wellness Markets:

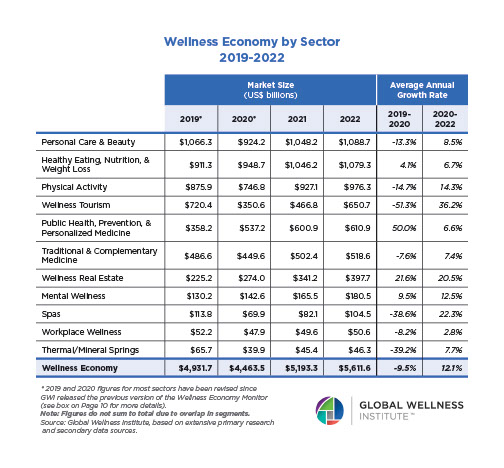

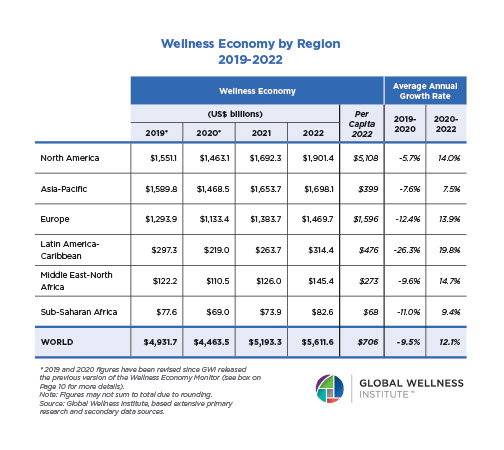

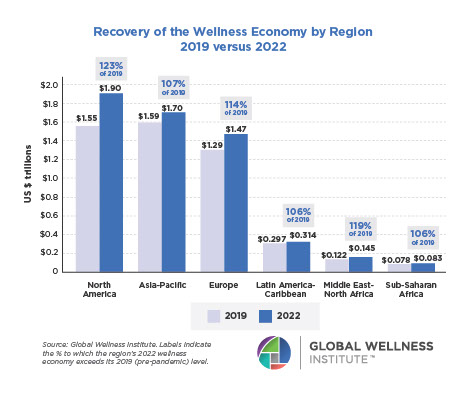

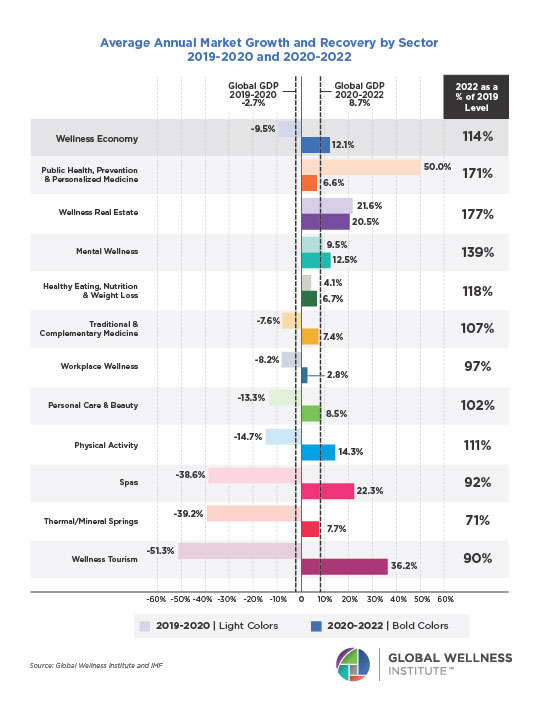

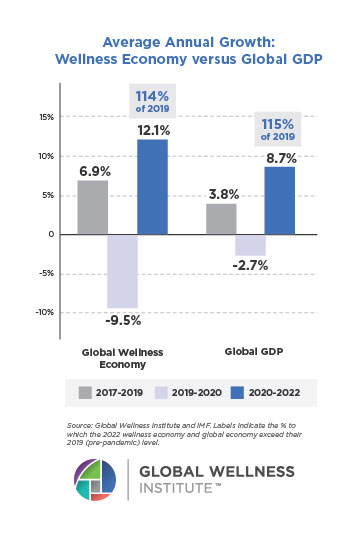

From GWI’s 2023 Global Wellness Economy Monitor report, these data snapshots of all 11 wellness markets are organized into three groups: 1) sectors that grew throughout the pandemic and have continued to grow; 2) sectors that initially shrank but have recovered from the pandemic; and 3) sectors that shrank significantly during the pandemic and have not fully recovered.

I) Wellness sectors that have grown throughout the pandemic and beyond:

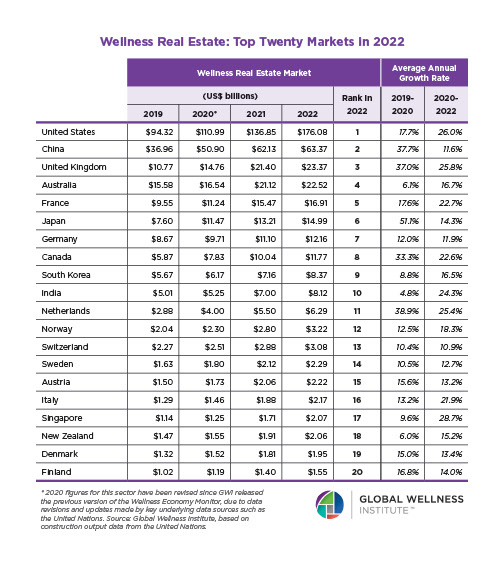

Wellness Real Estate:

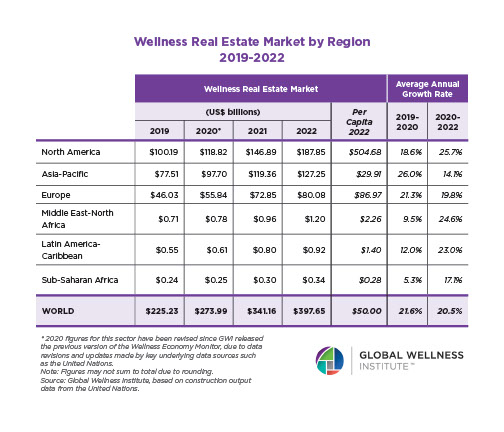

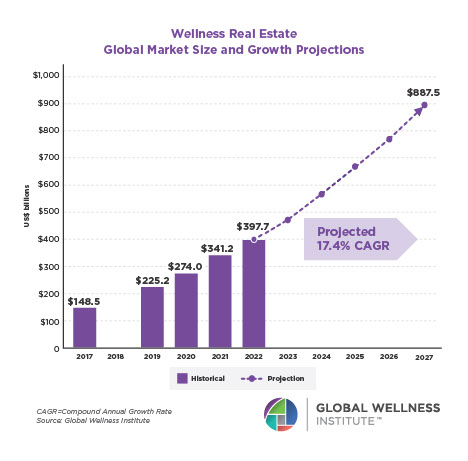

$398 billion market, +20.5% annual growth 2020-2022, at 177% of 2019 market level

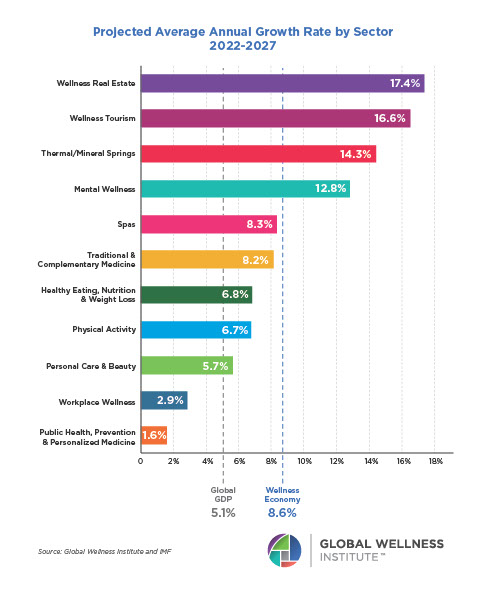

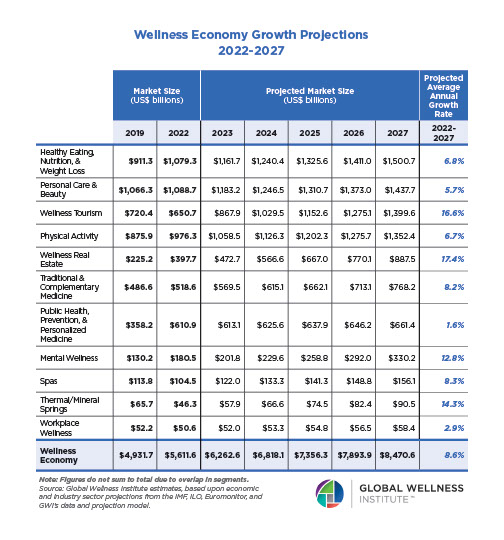

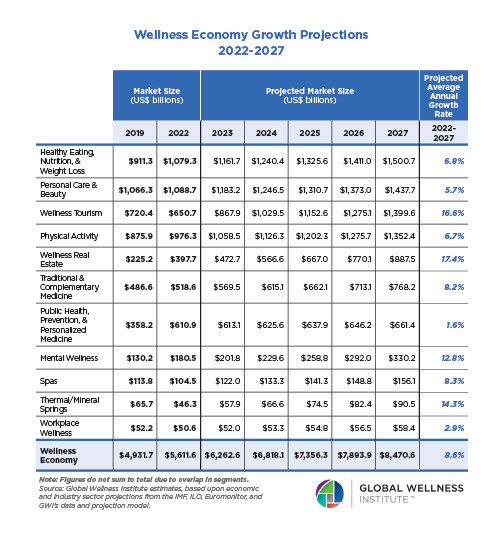

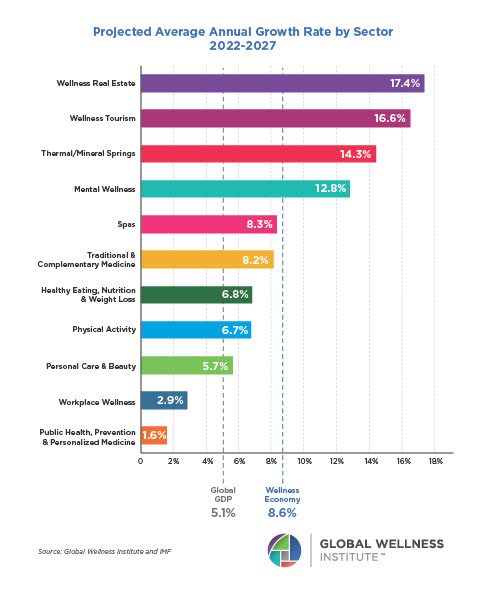

Projected annual growth rate 2022-2027: +17.4% to reach $887.5 billion

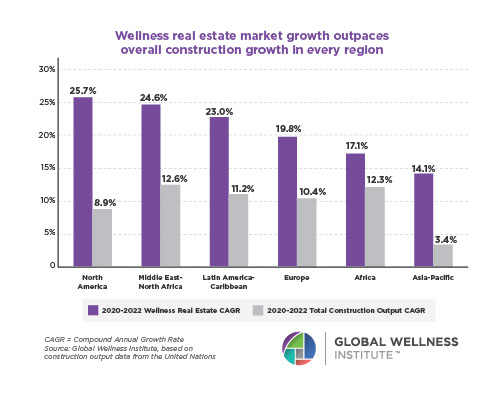

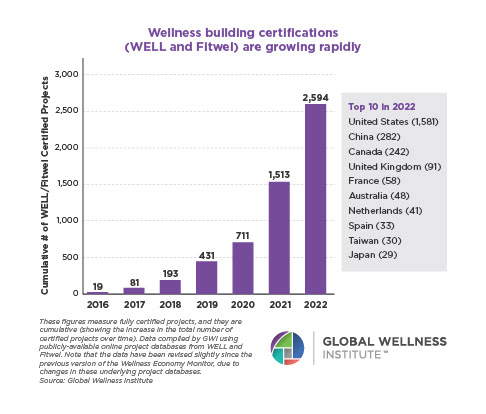

Wellness real estate has been the fastest-growing sector in the wellness economy since before the pandemic, significantly outpacing projections and economic growth trends—and is forecast to be the #1 growth leader through 2027. The pandemic radically accelerated the growing understanding among consumers and the building industry about the critical role that external environments play in our physical and mental health and wellbeing.

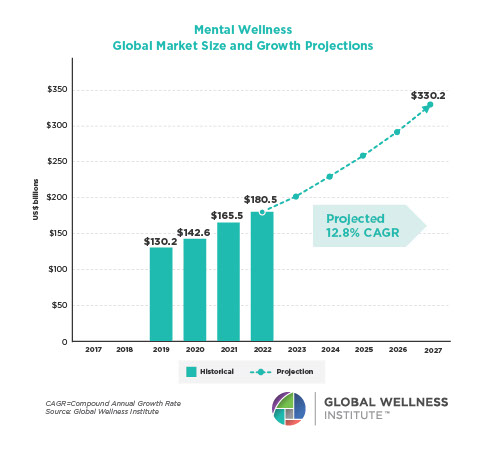

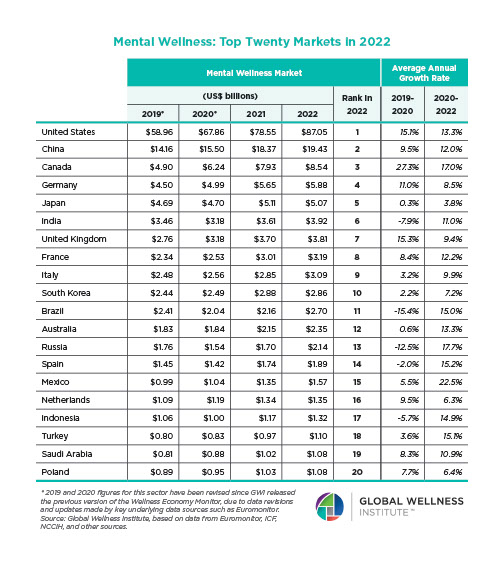

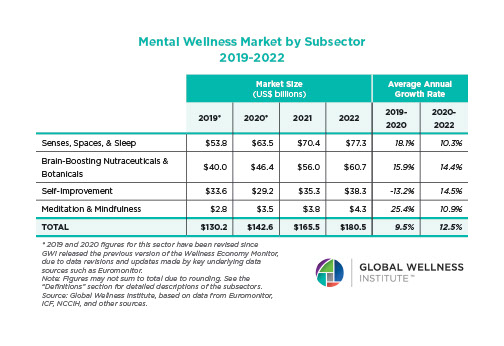

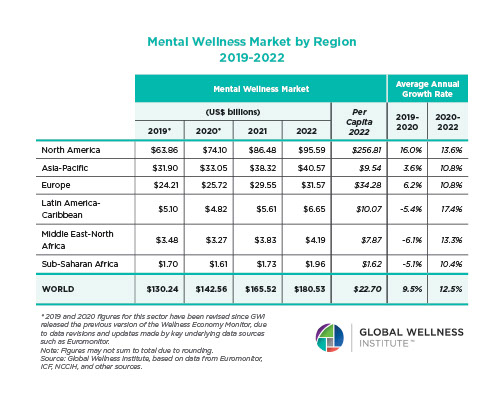

Mental Wellness:

$180.5 billion market, +12.5% annual growth 2020-2022, at 139% of 2019 market level

Projected annual growth rate 2022-2027: +12.8% to reach $330 billion

The mental wellness category – which includes 1) senses, spaces & sleep ($77.3 billion); 2) brain-boosting nutraceuticals & botanicals ($60.7 billion); 3) self-improvement ($38.3 billion) and 4) meditation & mindfulness ($4.3 billion) – has shown exceptional growth since 2019, as consumers desperately sought out products, services and activities to help them cope with the immense recent stress. Every type of product and service has posted strong growth in recent years: sleep solutions; sensory products and services; vitamins, supplements, and functional foods/beverages targeting brain health and energy (30% growth since 2019); cannabis (142% growth since 2019); self-improvement; coaching; and all kinds of meditation and mindfulness products and services.

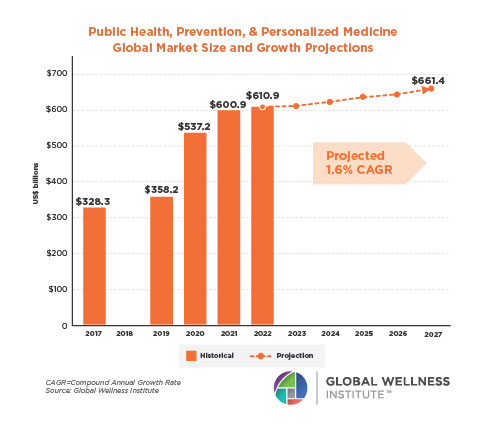

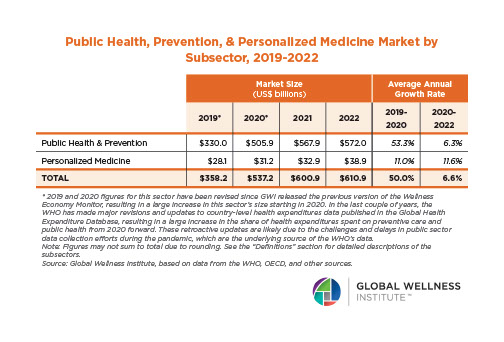

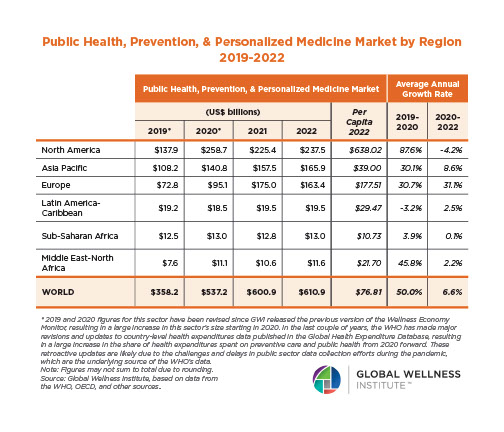

Public Health, Prevention & Personalized Medicine:

$611 billion market, +6.6% annual growth 2020-2022; at 171% of its 2019 market level

Projected annual growth rate 2022-2027: +1.6% to reach $661 billion

This sector grew by 50% in 2020, due to governments and healthcare systems significantly accelerating their public health and prevention expenditures during the pandemic. Worldwide, public and private spending on public health/prevention has increased as a share of overall health expenditures (from 3.9% in 2019 to 5.8% in 2021 and 2022) and remains far above pre-pandemic levels.

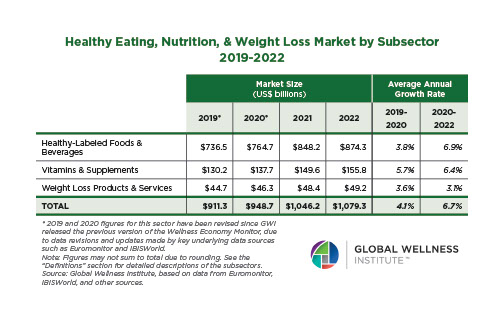

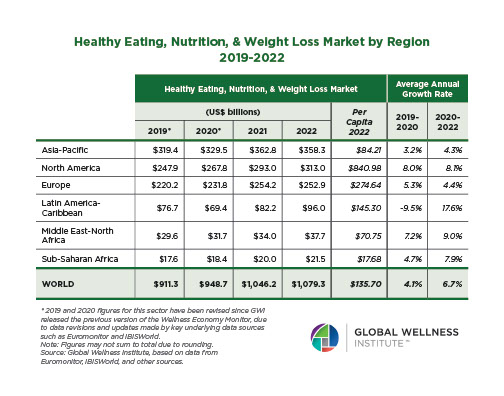

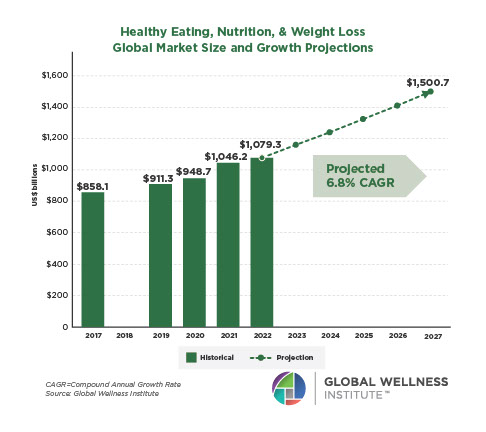

Healthy Eating, Nutrition & Weight Loss:

$1 trillion market, +6.7% annual growth 2020-2022; at 118% of its 2019 market level

Projected annual growth rate 2022-2027: +6.8% to reach $1.5 trillion

This category has grown steadily throughout the pandemic, as consumers sought out a variety of foods, beverages, vitamins, and supplements that they believed would strengthen their immunity and help ward off disease. GWI cautions that the growth in this sector should not be interpreted as “consumers were eating healthier” during (or since) the pandemic, as there is scant scientific evidence and no consensus on how healthy some of these products actually are. In addition, the growth in some countries reflects food price inflation, rather than an actual increase in consumer purchases.

II) Wellness sectors that initially shrank but have recovered from the pandemic:

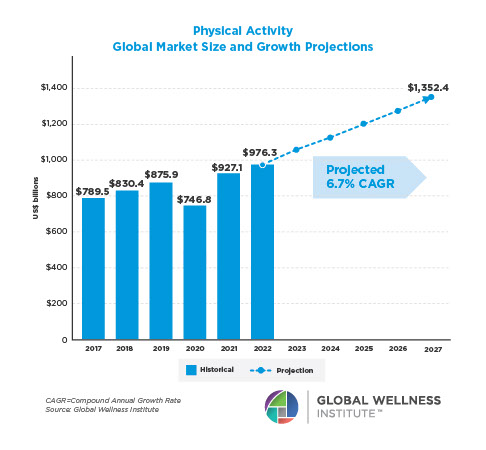

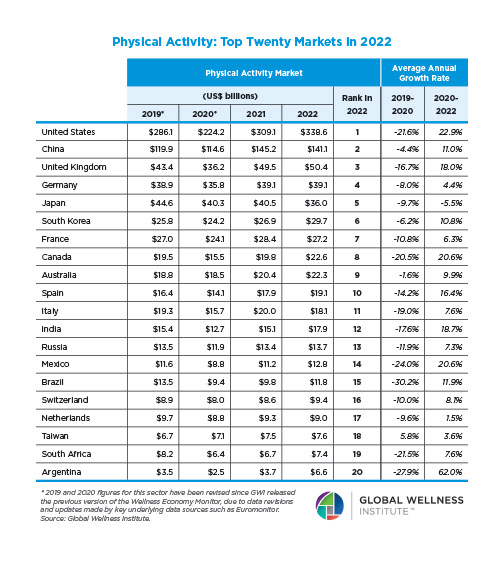

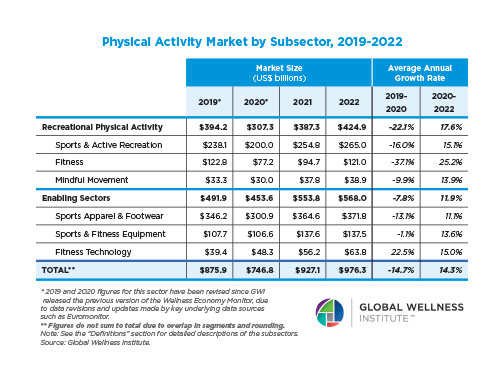

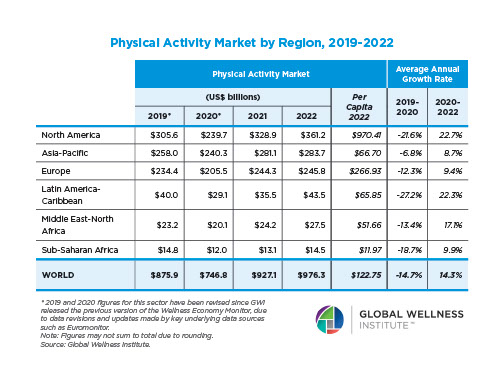

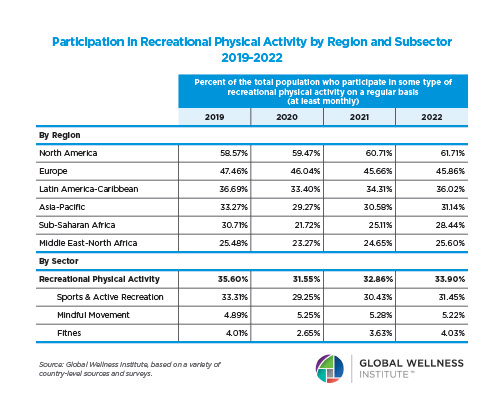

Physical Activity:

$976 billion market, +14.3% annual growth 2020-2022; at 111% of its 2019 market level

Projected annual growth rate 2022-2027: +6.7% to reach $1.4 trillion

The six-sector physical activity market saw declines in the first year of the pandemic, but has rebounded quickly in 2020-2022, as people returned to their exercise routines. Fitness (now a $121 billion market) was the most negatively impacted segment and has not yet returned to pre-pandemic levels, due to many factors (gym members not returning or shifting to online platforms, permanent gym closures, etc.). Mindful movement (yoga, Pilates, etc.), now a $39 billion market, saw a major boost in popularity during the pandemic and is the #1 growth leader compared to its pre-pandemic level (spending increased 16.8% from 2019 to 2022). Consumer spending on sports and active recreation (now a $265 billion market) has also grown rapidly, although participation rates are still below pre-pandemic levels. Fitness technology—spanning everything from wearable devices to digital workout platforms—exploded in 2020, and has clocked an impressive 15% annual growth from 2020 to 2022, to become a $64 billion market. The apparel & footwear ($372 billion) and equipment ($137.5 billion) markets have also been growing fast and now exceed their pre-pandemic levels.

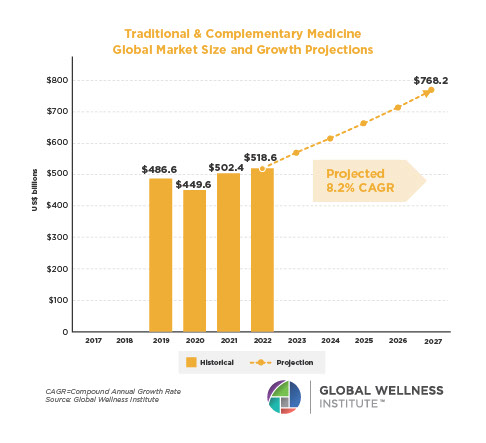

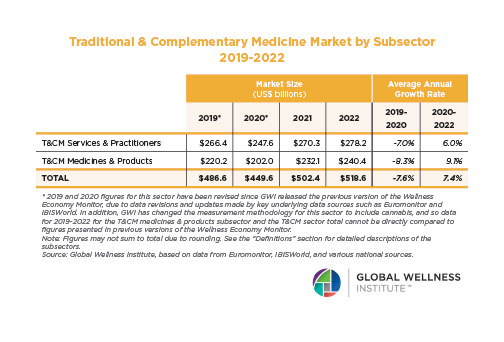

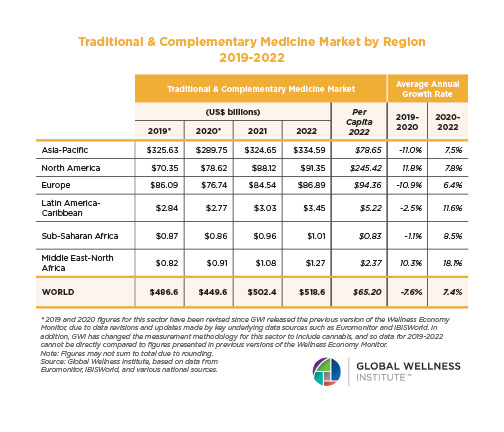

Traditional & Complementary Medicine (T&CM):

$519 billion market, +7.4% annual growth 2020-2022; at 107% of its 2019 market level

Projected annual growth rate 2022-2027: +8.2% to reach $768 billion

The T&CM sector initially shrank in 2020, due to business shutdowns disrupting visits to service providers and product manufacturing/sales. The market has rebounded in 2021-2022, and the pandemic has boosted overall demand for T&CM, as consumers increasingly seek out ways to strengthen their immunity, fend off sickness, and manage chronic conditions. The category is comprised of two subsectors: T&CM services and practitioners (now a $278 billion market), and T&CM medicines and products (a $240 billion market), and both have exceeded their pre-pandemic market levels. The rapid rise of the cannabis and CBD market, as regulatory regimes have loosened in many countries, has especially boosted the sector’s growth. The 9.1% annual global growth rate (2020-2022) of the T&CM medicines & products subsector is about 25% higher than it would have been if cannabis/CBD sales were not included. The figures include only the legal, over-the-counter cannabis and cannabis derivatives market. Most expenditures in this category overlap with the healthy eating, nutrition & weight loss, and mental wellness sectors, and this overlap is accounted for in the overall size of the global wellness industry.

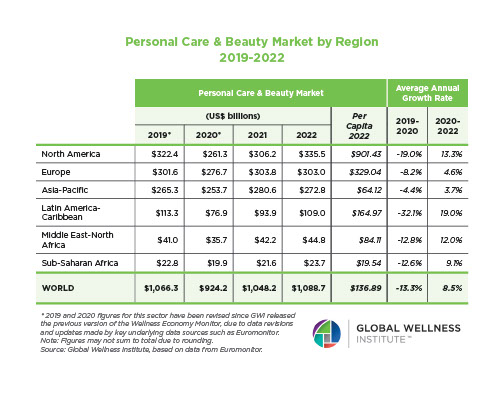

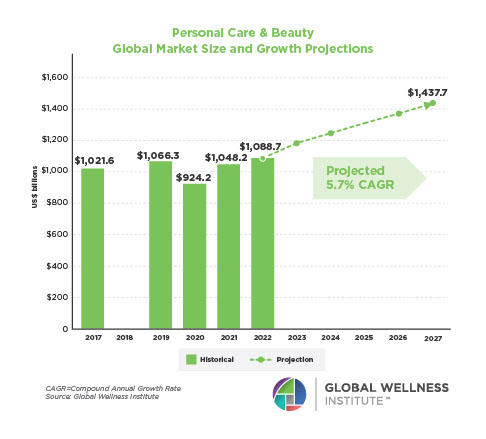

Personal Care & Beauty:

$1.1 trillion market, +8.5% annual growth 2020-2022; at 102% of its 2019 market level

Projected annual growth rate 2022-2027: +5.7% to reach $1.4 trillion

The beauty/personal care market shrank in 2020, with pandemic-related disruptions and an overall decline in consumer spending. But it recovered quickly in 2021-2022, and is now slightly above its pre-pandemic level, with a new record value of $1.1 trillion. The recovery and growth of personal care & beauty from 2020 to 2022 (8.5% annually) has mirrored the growth of overall consumer expenditures during this time (8.6% annual growth).

III) Wellness sectors that shrank significantly during the pandemic and have not fully recovered:

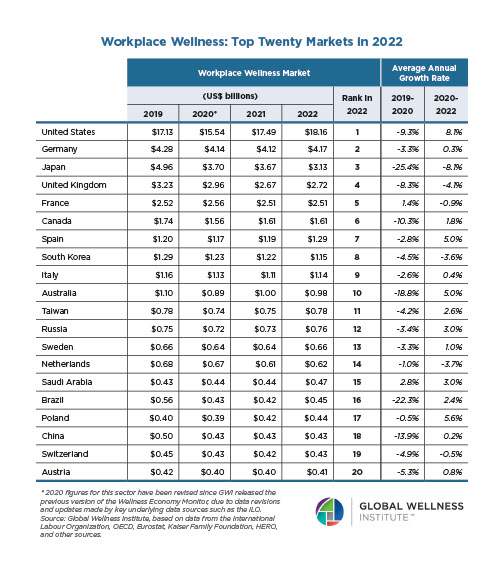

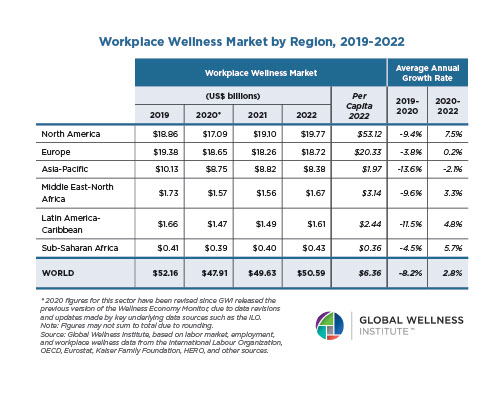

Workplace Wellness:

$51 billion market, +2.8% annual growth 2020-2022; at 97% of its 2019 market level

Projected annual growth rate 2022-2027: +2.9% to reach $58.4 billion

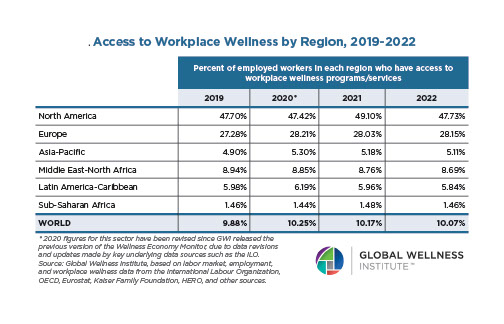

This sector contracted in 2020, as many of the traditional workplace wellness activities were curtailed during the pandemic amid business shutdowns and the dramatic shift to remote work. The sector rebounded in 2020-2022, but is not yet back to its pre-pandemic level. The market for workplace wellness is primarily driven by underlying labor characteristics across countries, including the share of workers in permanent or wage/salary jobs versus temporary, contract and gig jobs. As the structure of the global workforce changes, fewer workers are in jobs that have access to workplace wellness benefits. In addition, as employers shift toward more holistic (and meaningful) approaches for employee wellbeing, spending on employee wellness becomes more difficult to quantify. GWI estimates that approximately 339 million workers globally benefit from some form of workplace wellness program, representing only 10.1% of all employed workers in 2022.

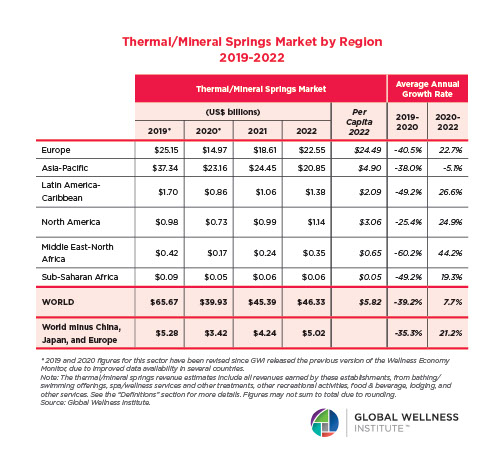

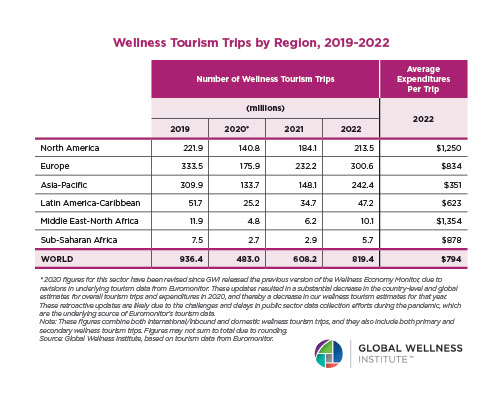

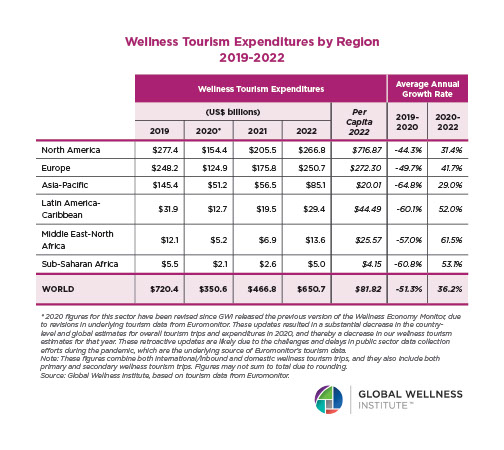

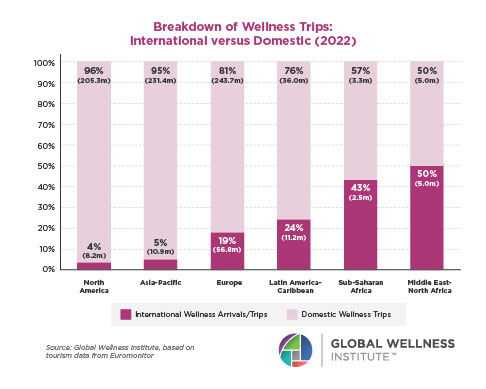

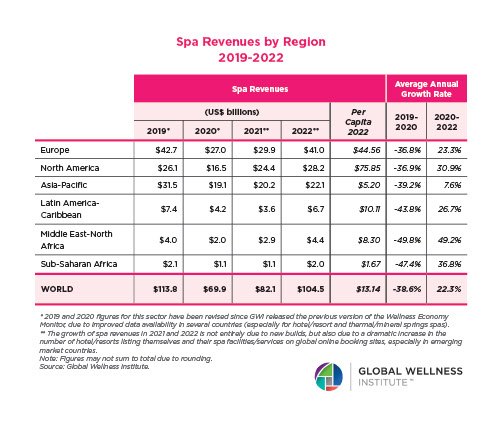

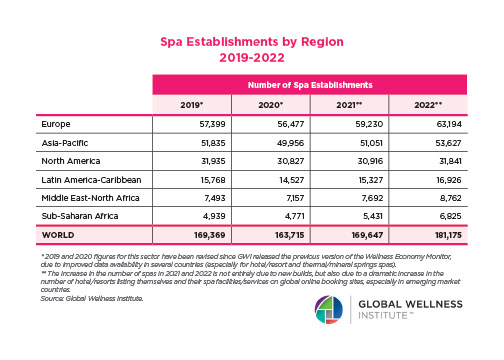

**Note on the wellness tourism, spa and thermal/mineral springs markets: These sectors were the hardest hit by the pandemic, given widespread travel restrictions and business shutdowns. All three grew rapidly in 2021-2022, but haven’t quite yet recovered to their pre-pandemic levels. A key factor is the ongoing recovery of the global tourism market: as of 2022, international trips were still at 62% of their pre-pandemic level, and domestic trips were at 73% (Euromonitor data). The Asia-Pacific region has especially lagged in recovery, due to prolonged pandemic restrictions and border closures in China, the dearth of Chinese tourists throughout the region, weakening economic conditions in China and Japan, currency depreciation, and other factors.

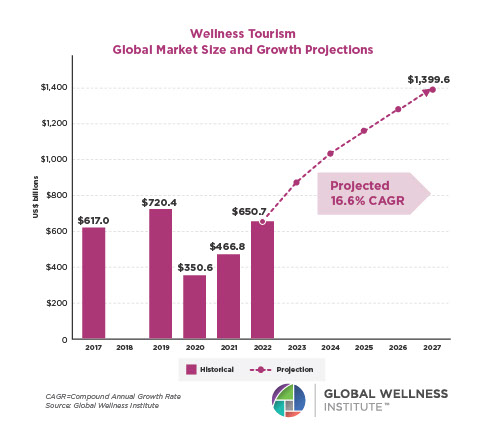

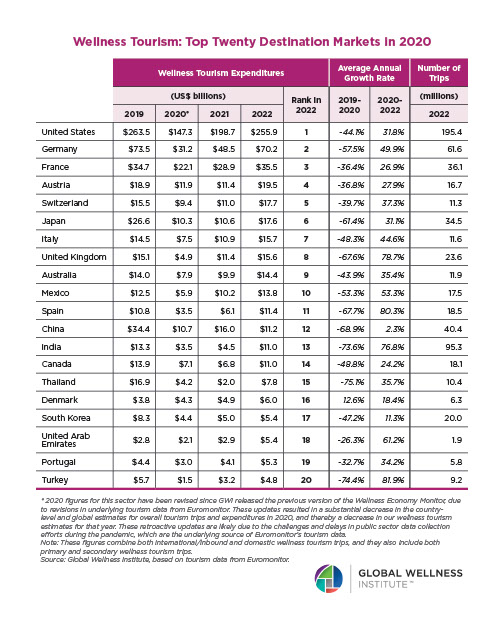

Wellness Tourism:

$651 billion market, +36% annual growth 2020-2022; at 90% of its 2019 level

Projected annual growth rate 2022-2027: +16.6% to reach $1.4 trillion

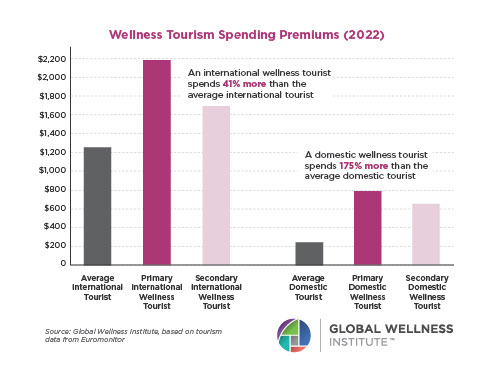

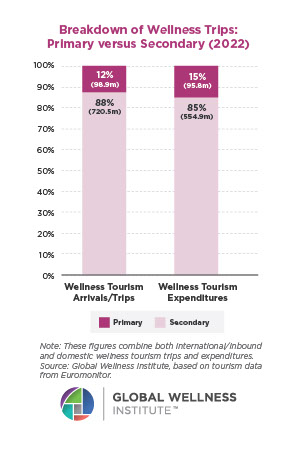

The wellness tourism market plummeted from 2019 to 2020 ($720 billion to $351 billion), but has seen extraordinary 36% annual spending growth, and 30% annual wellness trip growth, from 2020 to 2022—significantly higher than growth rates for overall tourism trips and expenditures, at 23.8% and 28.4%. Wellness travelers made 819.4 million international and domestic wellness trips in 2022, a major increase over 2020 (483 million) and 2021 (608 million) levels. Wellness trips accounted for 7.8% of all tourism trips but represented 18.7% of all tourism expenditures in 2022 (so almost 1 in 5 total “travel dollars”). The wellness tourism market is forecast to more than double from 2022 to 2027, with dramatic spending jumps from 2022 ($651 billion) to 2023 ($868 billion) to 2024 ($1 trillion), as the market continues its supercharged recovery. After that, it’s likely to taper off to a still strong, but less overheated growth curve.

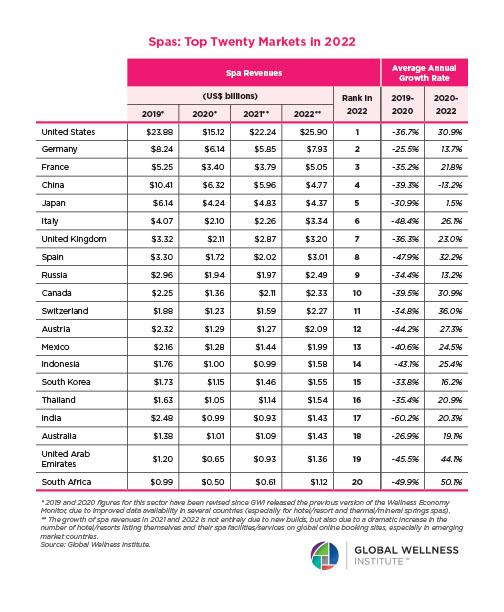

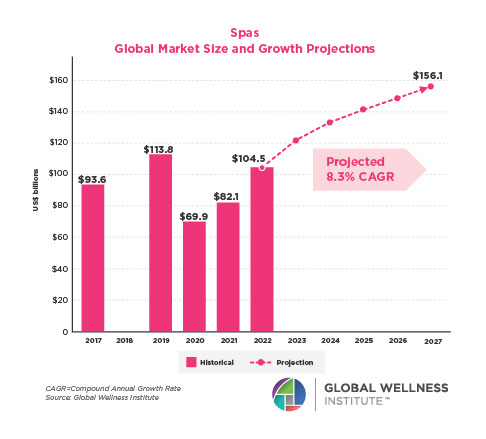

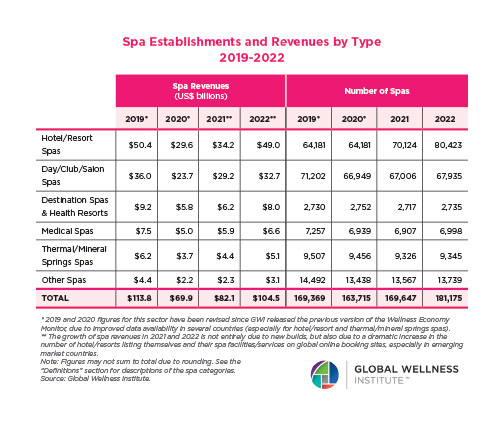

Spas:

$104.5 billion market, +22% annual growth 2020-2022; at 92% of 2019 market level

Projected annual growth rate 2022-2027: +8.3% to reach $156 billion

Spas, the highest-touch wellness market, took a huge hit from 2019 to 2020 (the market fell from $114 billion to $70 billion). But with pent-up demand, the spa industry has recovered fast to reach a $104.5 billion market. At the regional level, the spa markets in North America and Middle East-North Africa (the #1 growth leader at roughly 50% annual revenue growth from 2020 to 2022) now exceed their pre-pandemic levels. Most other regions are at 90% or more of their 2019 peak. There are now 181,175 spas operating around the world. Hotel/resort spas now have both the largest revenues ($49 billion) and the largest number of establishments (80,423) across all types of spas–and hotel spa revenues grew the fastest (29% annually) from 2020-2022. The spa industry is rapidly evolving beyond massage and facials, now adding new wellness modalities and revenue streams (e.g., sound baths, hyperbaric oxygen chambers, cryotherapy, IV drips, infrared lighting treatment, acupuncture, reiki, etc.).

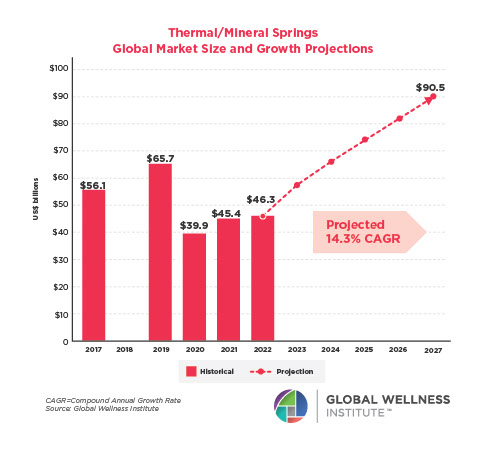

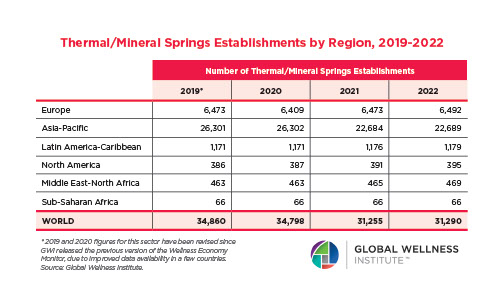

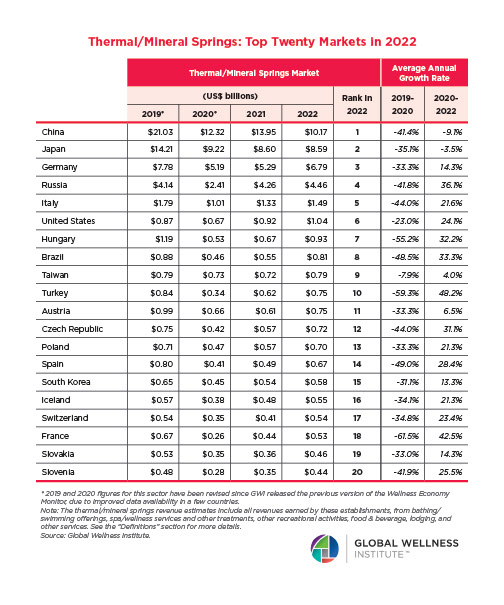

Thermal/Mineral Springs:

$46.3 billion market, +7.7% annual growth 2020-2022; 71% of 2019 market level

Projected annual growth rate 2022-2027: +14.3% to reach $90.5 billion

The hot springs sector took a bath from 2019 to 2020, with revenues dropping from $66 billion to $40 billion, fueled by a protracted downturn in certain Asian and European countries. But the picture hasn’t been gloomy overall for the industry. If China, Japan and Europe are removed from the data, a very different growth story emerges. Across North America, the rest of Asia-Pacific and Latin-America, the sector has grown at a powerful 21% annually since 2020. The GWI predicts that the total global market will surpass pre-pandemic levels by 2024. There are currently 31,290 thermal/mineral springs establishments operating in 130 countries.

FEATURED REPORTS