GWI’s New Report Ranks the Wellness Economies of 145 Countries

In January 2024, GWI released its latest data report, The Global Wellness Economy: Country Rankings (2019-2022). A companion to GWI’s flagship report, the Global Wellness Economy Monitor, this new report is the only place to find detailed data on the size and growth of the wellness industry at the country level. In addition to providing wellness economy numbers for 145 countries, the report puts a spotlight on recent growth and developments in the top 25 largest markets.

Key findings from the top 25 wellness economy country rankings:

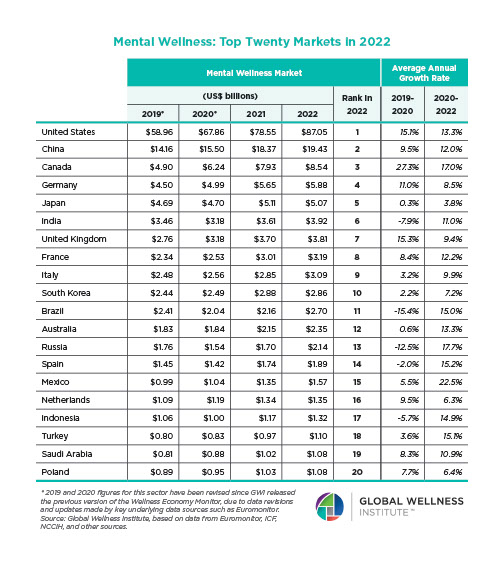

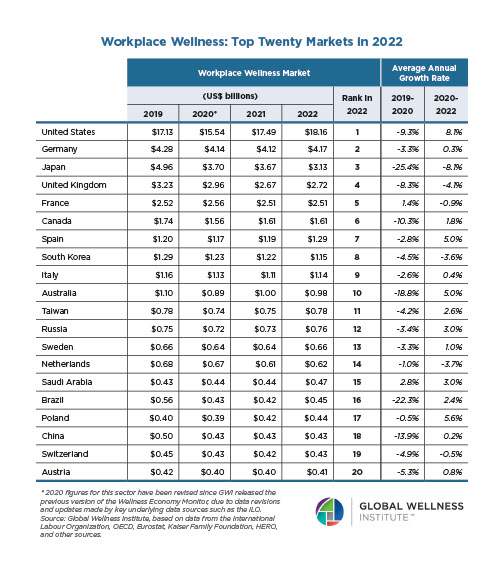

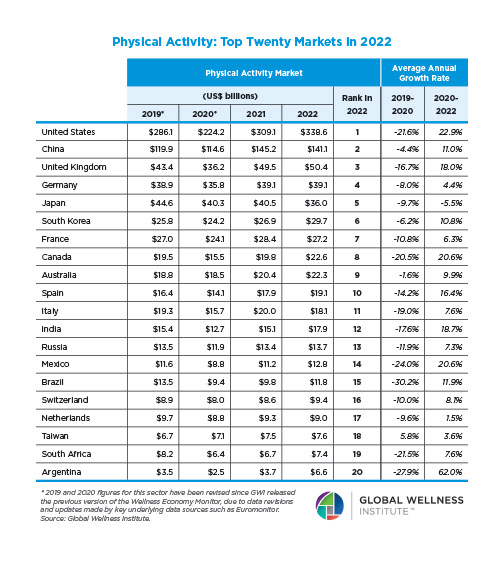

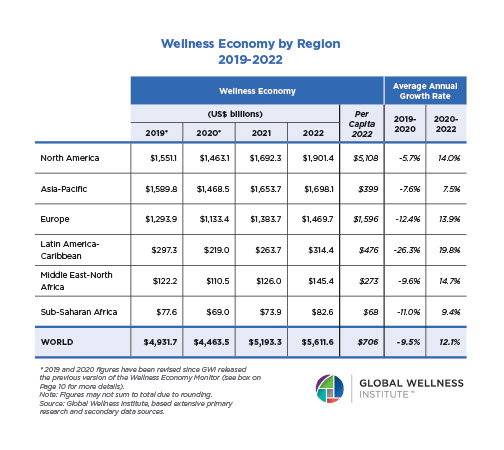

- In 2022, the United States remained the undisputed goliath in wellness spending. With an annual market worth $1.8 trillion, the US wellness economy is more than double the size of the second-largest market (China). The United States also ranks first in 9 of the 11 wellness sectors.

- Other countries rounding out the top five include China ($790 billion), Germany ($269 billion), Japan ($241 billion), and the United Kingdom ($224 billion).

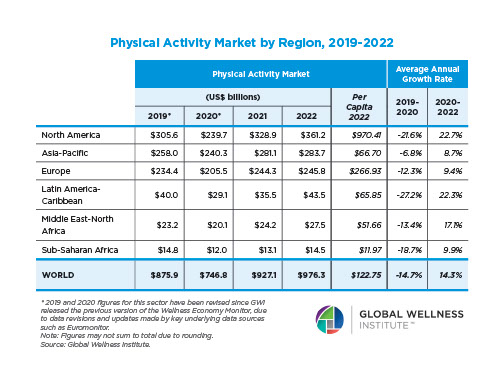

- The global wellness economy is heavily concentrated in the largest country markets. The top ten largest markets represent 70% of the global total, while the top 25 markets represent 86%. The United States alone accounts for 32% of the entire global wellness economy in 2022.

- The largest wellness markets tend to be countries that are very rich (e.g., Switzerland, Sweden), countries that are very large in terms of population (e.g., China, Indonesia, Brazil), or countries that are both large and rich (e.g., United States, Germany, Japan).

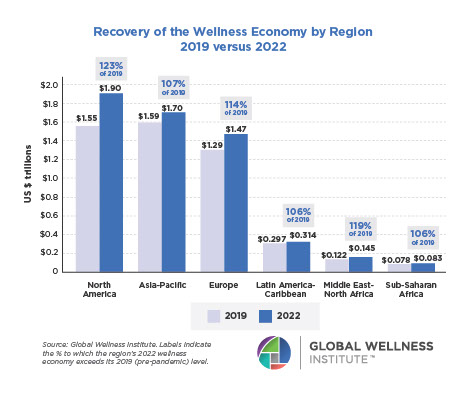

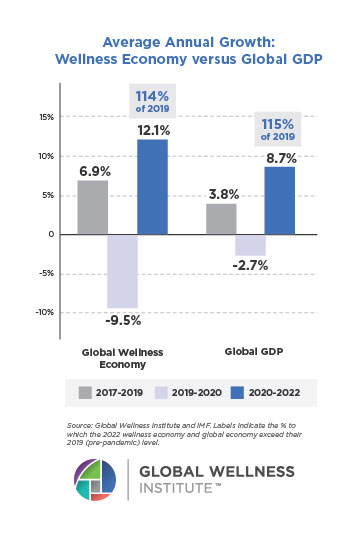

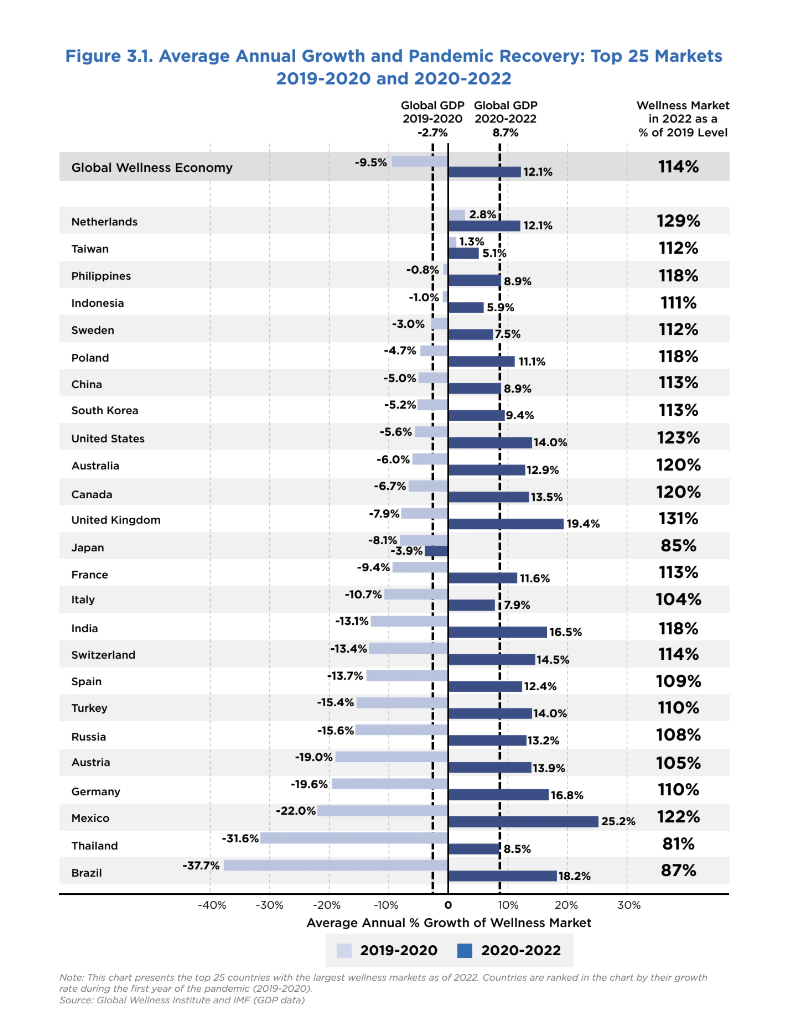

- The 25 largest wellness markets have mostly recovered from the pandemic and have resumed a robust growth trajectory. When we compare the size of the national wellness economies in 2022 with 2019, all but three (Thailand, Japan, Brazil) of the top 25 markets have surpassed their pre-pandemic size when their markets are measured in US dollars.

- Large wellness markets with especially strong growth and recovery since the pandemic include the United Kingdom, the Netherlands, the United States, Mexico, Canada and Australia. In 2022, the wellness economies of all six countries surpassed their 2019 size by 120% or more.

- Currency depreciation has affected the measurements of some major wellness markets, including Japan, Brazil and the Euro zone countries. In these countries, the performance of the wellness economy is stronger when measured in their local currencies.

DOWNLOAD THE FULL REPORT HERE