A Decade of Wellness Tourism: First-Ever Compilation of 10+ Years of Market Data

In 2013, the Global Wellness Institute (GWI) unveiled the Global Wellness Tourism Economy report—a landmark study that defined the parameters and characteristics of the emerging wellness tourism sector and provided, for the first time, market size estimates at the global, regional, and country levels. In that report, GWI first measured wellness tourism at $439 billion 2012. Since then (and especially in the aftermath of the pandemic), wellness has become a major force in the global tourism market. After releasing that first wellness tourism report, GWI has periodically provided updated wellness tourism figures in our flagship report, the Global Wellness Economy Monitor.

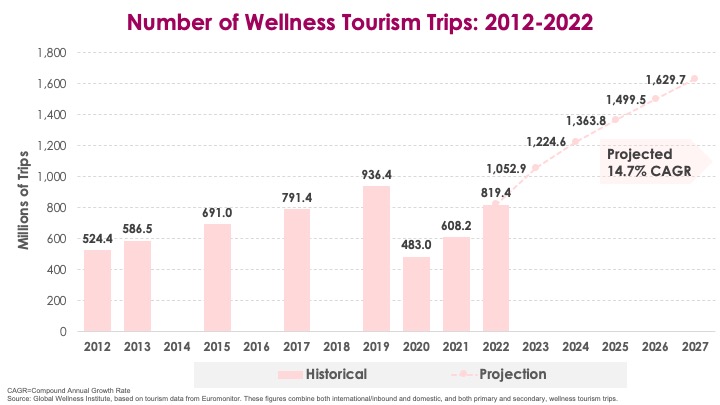

For this feature, GWI’s researchers have compiled all our historical data on the global wellness tourism sector, providing a first-ever snapshot of our full time-series dataset from 2012 to 2022, and projecting forward to 2027.

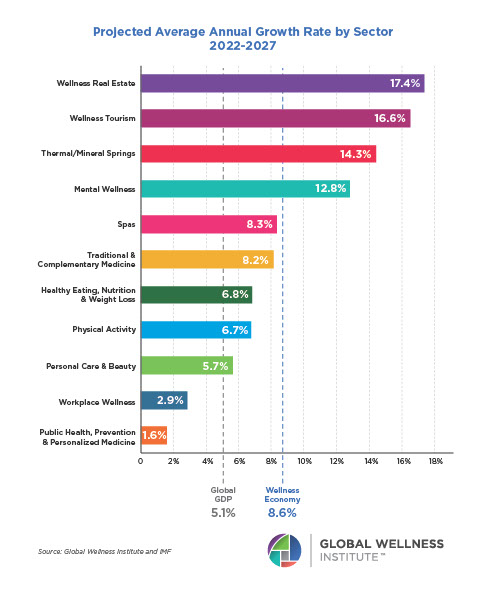

Wellness tourism has consistently been one of the fastest-growing sectors in the wellness economy.

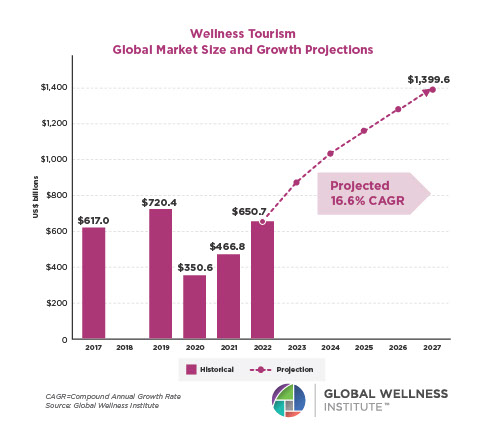

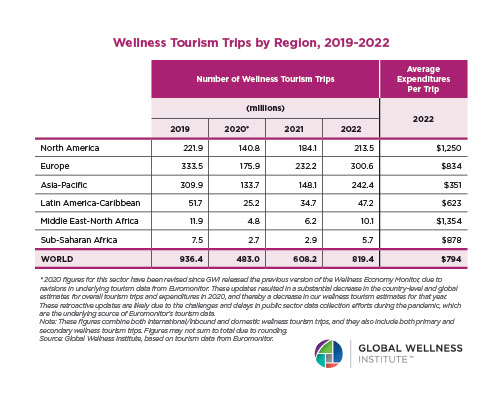

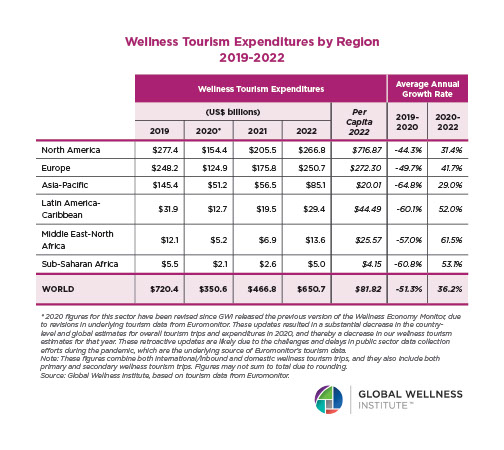

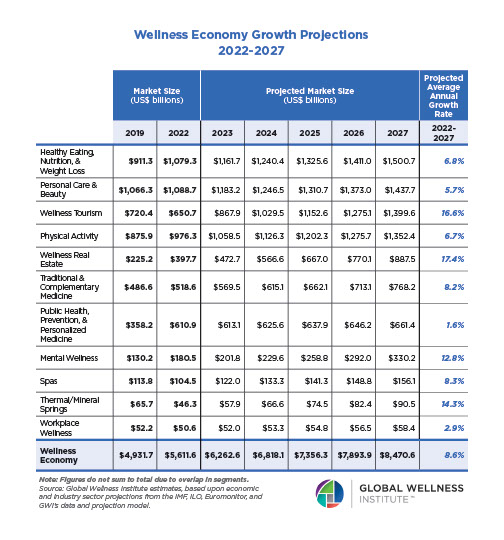

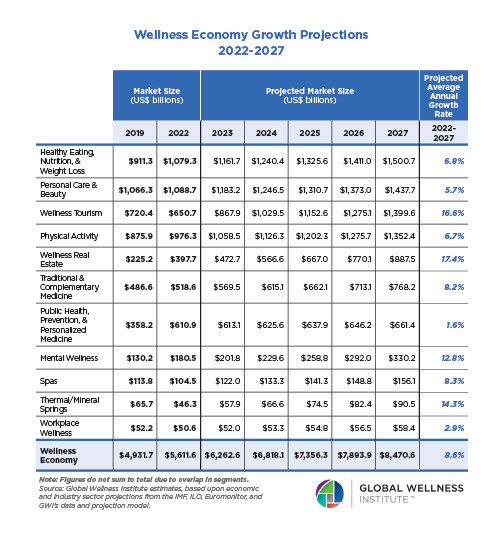

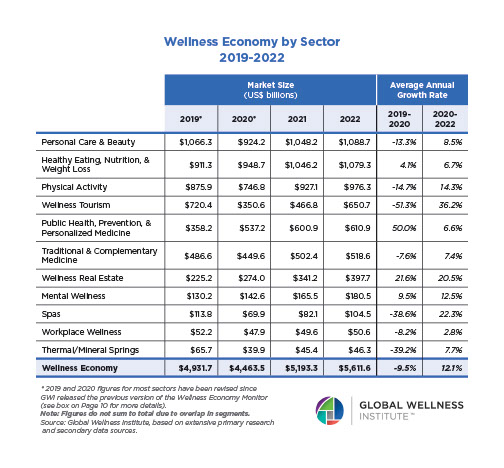

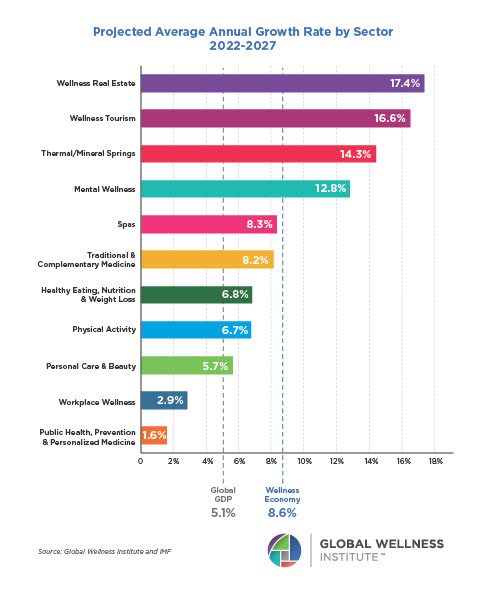

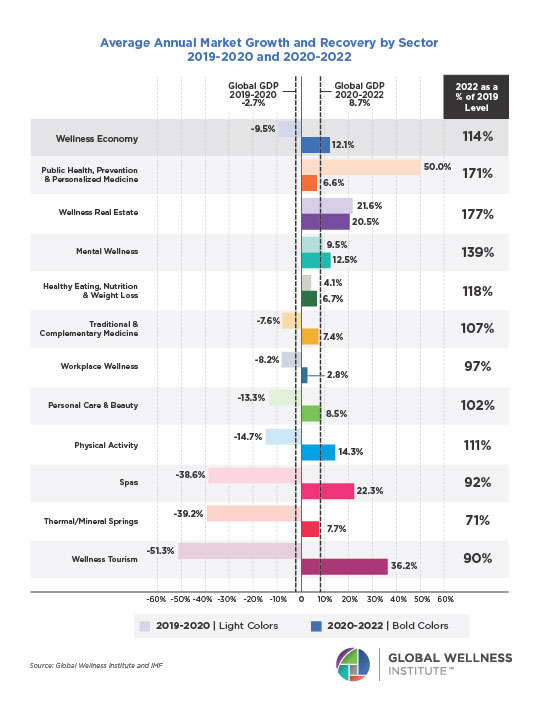

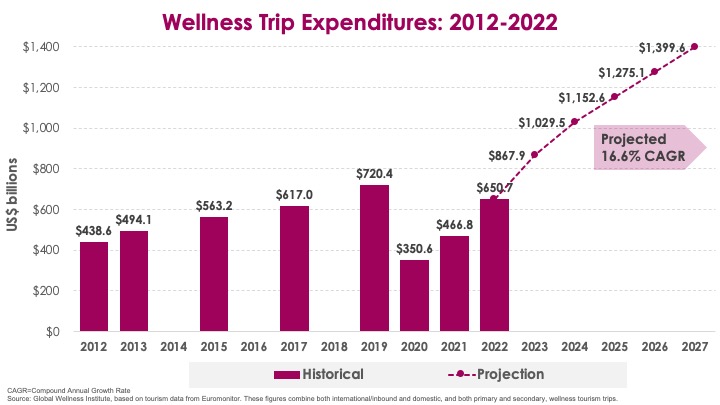

Wellness tourism was one of the fastest-growing wellness economy sectors prior to 2020. From 2012 to 2019, the global number of wellness tourism trips grew by 8.6% annually, peaking at 936.4 million trips globally in 2019. Wellness tourism expenditures grew by 7.3% annually during this same time period, peaking at $720.4 billion in 2019. After a major downturn in 2020, due to the COVID-19 pandemic, the wellness tourism sector has gradually recovered in 2021 and 2022, along with the relaxing of pandemic-related travel restrictions and the recovery of the overall tourism market. From 2020 to 2022, wellness trips have grown by 30.2% annually and expenditures have grown by 36.2% annually. The global wellness tourism market is projected to fully recover to—and exceed—its pre-pandemic level as of 2023, with projected annual growth rates of 14.7% for wellness trips and 16.6% for wellness trip expenditures through 2027.

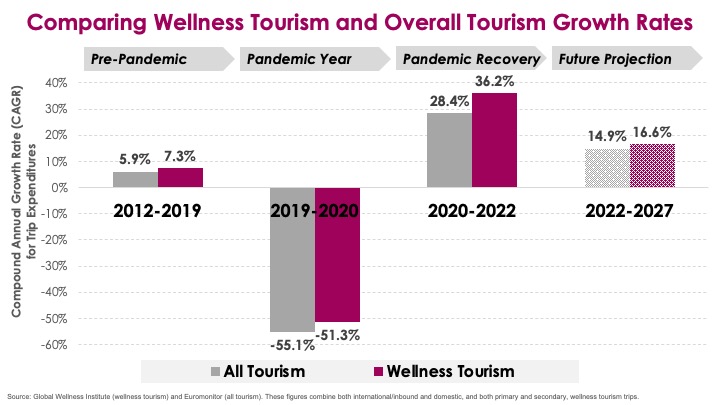

Wellness tourism has outperformed the overall tourism industry for over a decade.

As evident in the chart below, wellness tourism expenditures have grown faster than overall global tourism expenditures every year since 2012. Prior to the pandemic, wellness tourism was growing at an average annual rate of 7.3% from 2012 to 2019, a rate that is 25% higher than the growth trend for tourism in general. In the first year of the pandemic (2019-2020), wellness tourism fared slightly better than overall tourism, with wellness tourism spending falling by 51.3%, while overall tourism spending fell by 55.1%.

Since then, wellness tourism has resumed a rapid growth trajectory as it recovers from the 2020 downturn, growing at a pace that is 27% faster than the overall tourism growth rate from 2020 to 2022. Forecasting forward to the next five years, wellness tourism expenditures are projected to maintain a strong growth trajectory, well above that for the overall tourism sector.

Wellness tourism continues to expand its share of the overall tourism market.

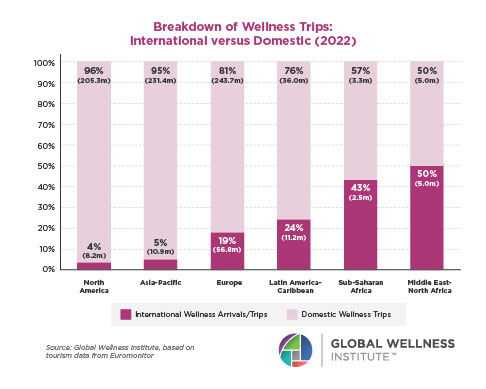

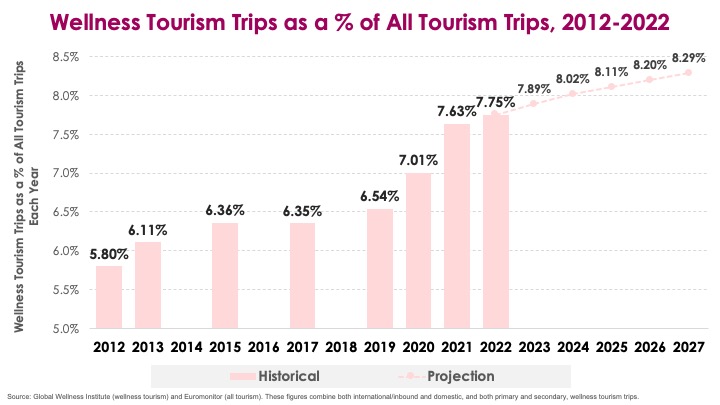

In 2012, GWI estimated that wellness travelers took 524.4 million trips (both internationally and domestically), representing 5.8% of all tourism trips taken around the world that year. With wellness tourism growing faster than overall tourism for more than a decade, it has also grown in its share of the overall tourism market. In 2022, the 819.4 billion wellness trips taken (both internationally and domestically) represented 7.8% of all tourism trips—a much larger share of the market than just a decade earlier. Wellness trips are projected to rise to 8.3% of all tourism trips by 2027.

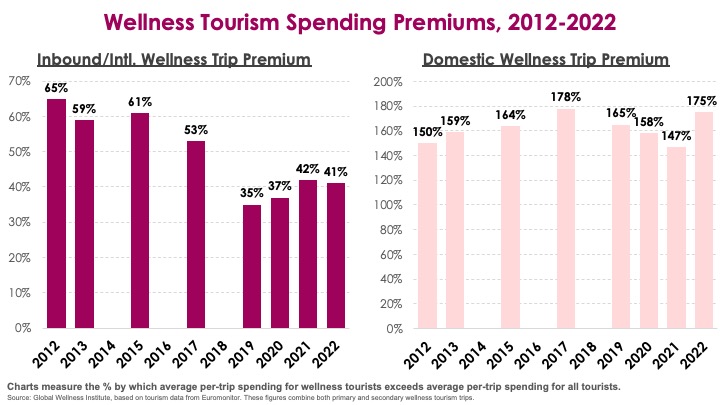

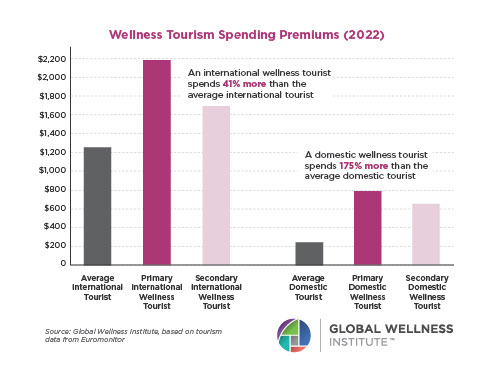

Wellness tourists consistently spend more money than the average tourist, although the premiums for different types of wellness tourists have shifted over time.

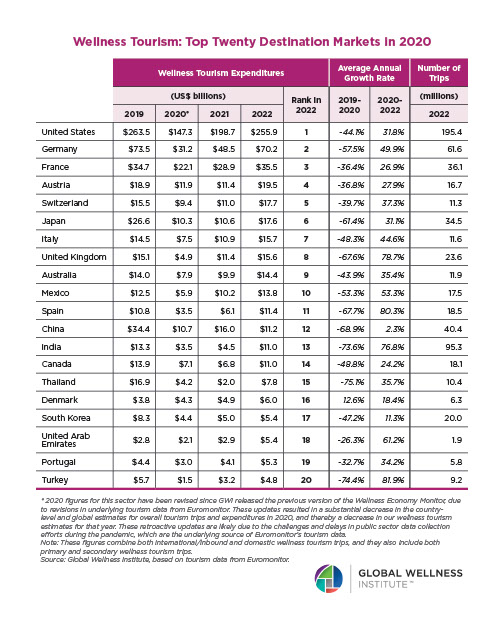

Wellness tourism is high-yield tourism, and wellness travelers are increasingly targeted by destinations around the world because they spend more per trip than the average tourist. This holds true for both domestic and international travelers. In 2022, international wellness tourists on average spent $1,764 per trip, which is 41% more than the typical international tourist. The spending premium for domestic wellness tourists was even higher, at 175% more than the typical domestic tourist (or $668 per trip).

Looking at the **time-series data for 2012-2022, it is interesting to note that the spending premium for inbound/international wellness tourists has declined (from 65% in 2012 to 41% in 2022). Meanwhile, the premium for domestic wellness tourists has increased (from 150% in 2012 to 175% in 2022).

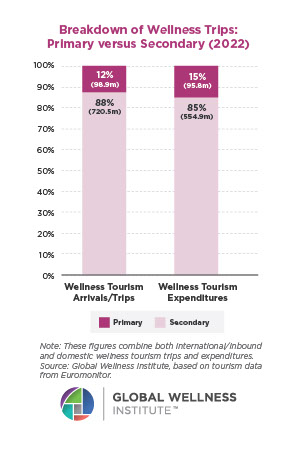

- The change in the international trip premium is likely due to a number of factors, including the strong growth of “secondary wellness trips” relative to “primary wellness trips” (because secondary wellness travelers tend to spend less per trip than primary wellness travelers). In addition, the range of offerings for wellness travelers has exploded over the last decade, with many more choices available at different price points, meaning that these experiences have become more accessible to middle-market travelers.

- For the domestic trip premium, the recent shifts in the data may be due to the explosion in domestic travel during the pandemic (with people taking trips close to home while many international borders remained closed through 2022). It remains to be seen whether the domestic spending premium remains elevated or levels off as the tourism market fully recovers in the coming years.