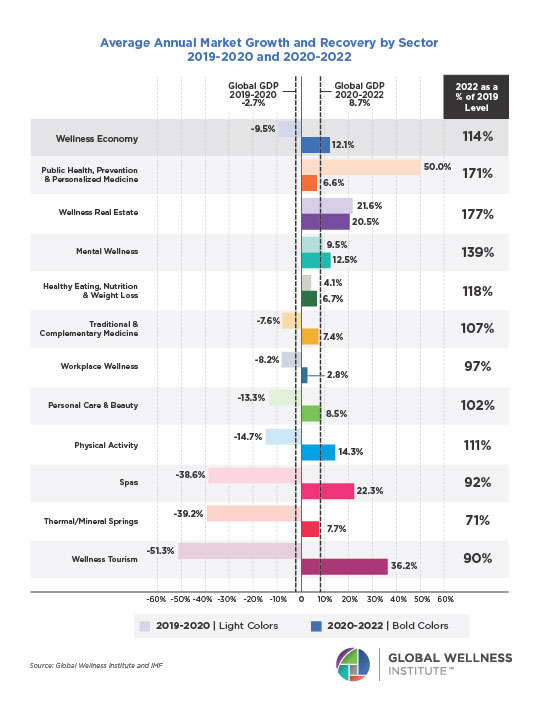

Wellness sectors that have grown throughout the pandemic:

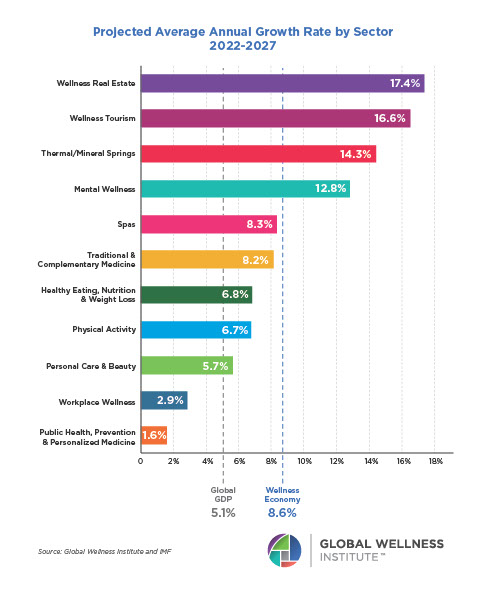

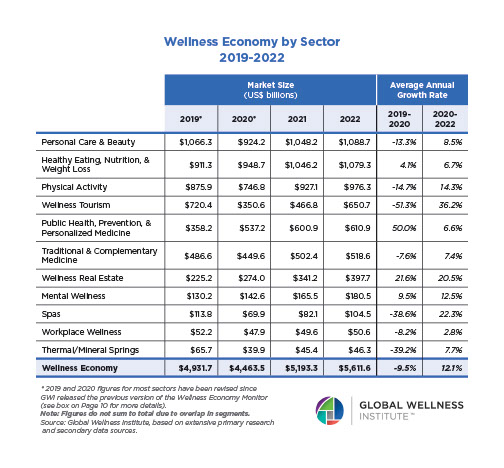

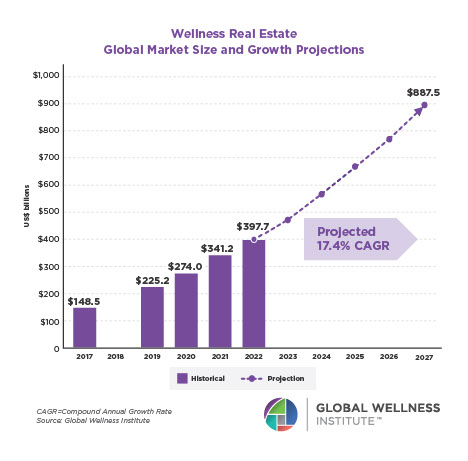

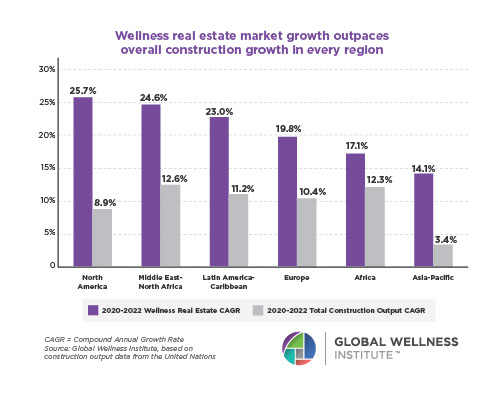

- Wellness real estate (+18.1% annual growth 2019-2023; now at 195% of its 2019 level) has been the fastest-growing sector in the wellness economy since before the pandemic, significantly outpacing projections and economic growth trends. COVID-19 has accelerated the growing understanding among consumers and the building industry about the critical role that external environments play in our physical and mental health and well-being.

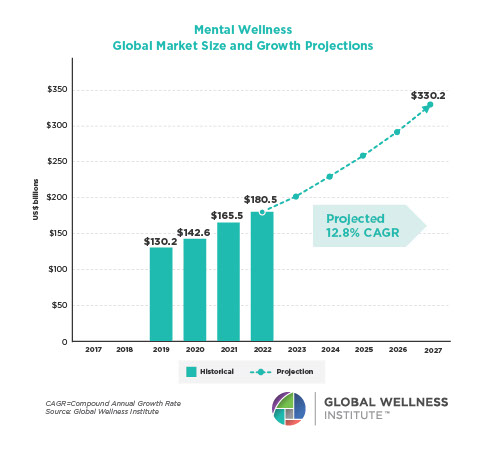

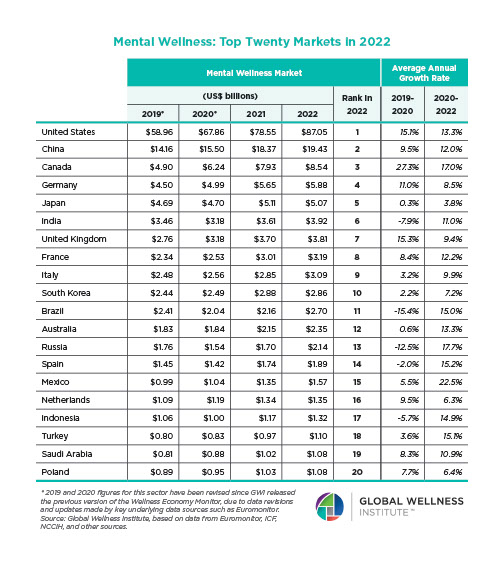

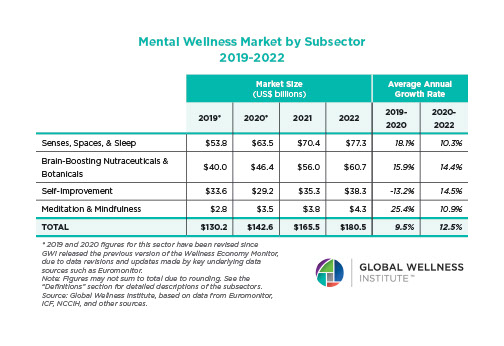

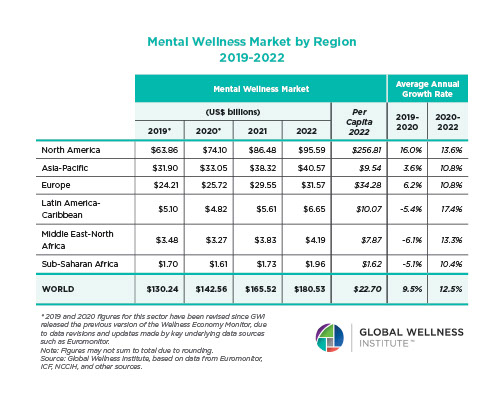

- Mental wellness (+11.6% annual growth 2019-2023; now at 155% of its 2019 level) has grown strongly since 2019, as consumers desperately sought out products, services, and activities to help them cope with the immense stresses they faced during the pandemic and beyond. All types of products and services have posted strong growth in recent years: sleep solutions; sensory products and services; vitamins, supplements, and functional foods/beverages targeting brain health and energy; cannabis; self-improvement; coaching; and all kinds of meditation and mindfulness products and services. Many mental wellness activities are done at home or via tech platforms, and many products are inexpensive and/or easily purchased online, which helped to keep spending high amidst COVID disruptions.

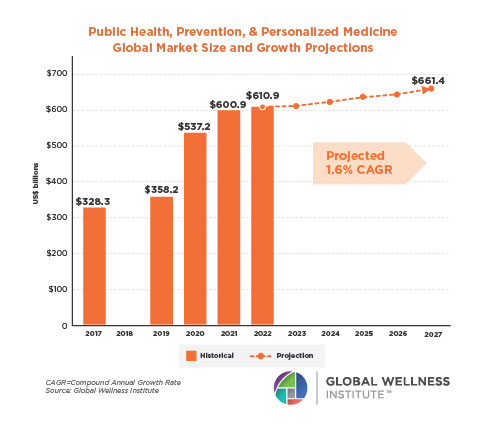

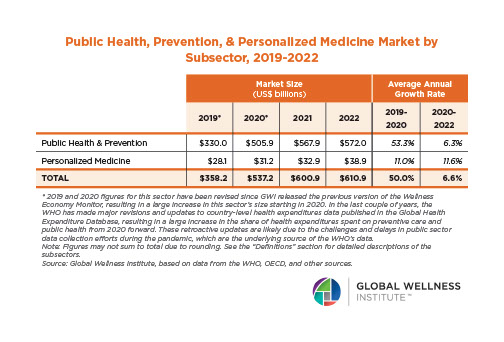

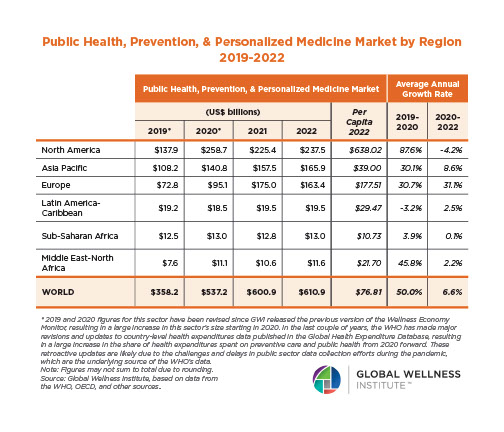

- Public health, prevention, & personalized medicine (+15.2% annual growth 2019-2023; now at 176% of its 2019 level) grew by 42.8% in 2020, due to governments and healthcare systems accelerating their public health and prevention expenditures in response to the pandemic. Worldwide, public and private spending on public health/prevention has increased as a share of overall health expenditures (from 4.0% in 2019 to 6.1% in 2021-2023) and remains far above pre-pandemic levels.

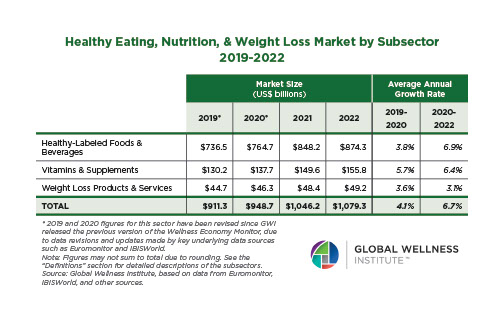

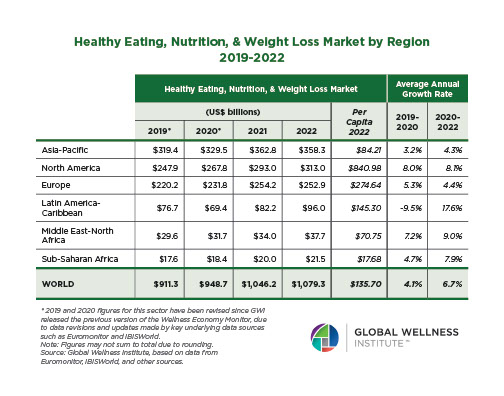

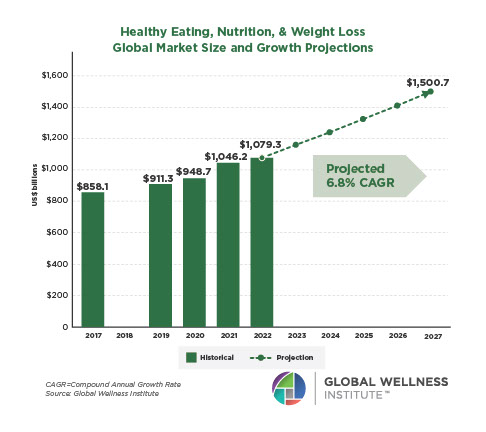

- Healthy eating, nutrition, & weight loss (+4.7% annual growth 2019-2023; now at 120% of its 2019 level) has grown throughout the pandemic, as consumers sought out a variety of packaged foods and beverages, vitamins, and supplements that they believed would strengthen their immunity and help ward off disease. GWI cautions that the growth in this sector should not be interpreted as “consumers were eating healthier” during the pandemic, as there is scant scientific evidence and no consensus on how healthy these products actually are. In addition, the growth in some countries reflects food price inflation, rather than an actual increase in consumer purchases.

Wellness sectors that initially shrank but have recovered from the pandemic:

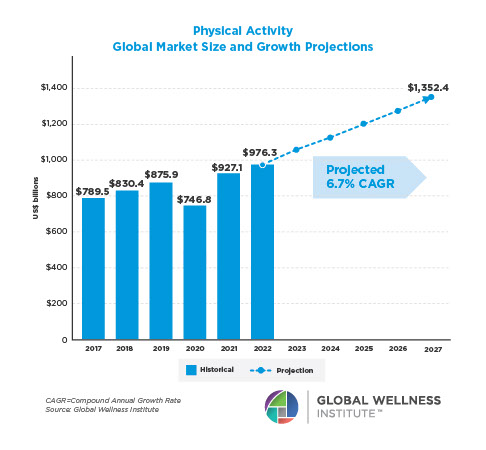

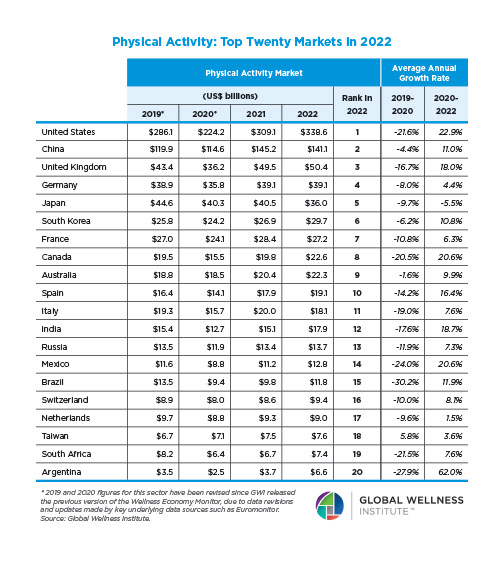

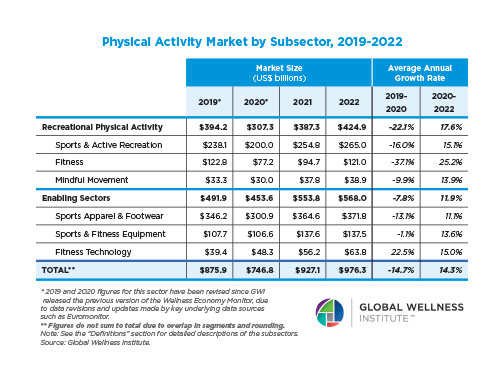

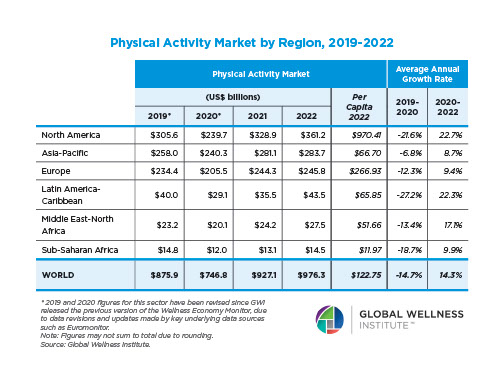

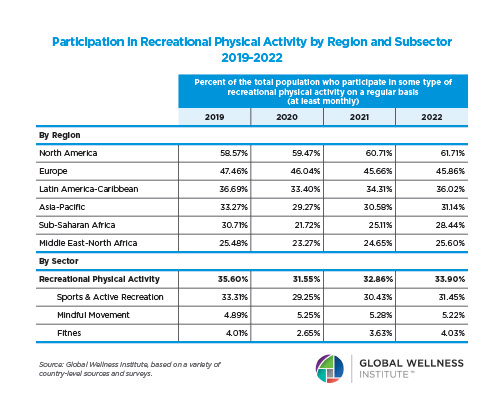

- Physical activity (+4.1% annual growth 2019-2023; now at 117% of its 2019 level) declined by 14.6% in the first year of the pandemic, but it has rebounded quickly in 2021-2023 as people returned to their regular activities and exercise routines. Fitness was the most negatively impacted segment in 2020; while it has recovered and exceeds its pre-pandemic levels of spending, we estimate that participation rates for traditional gyms/fitness centers are still slightly down (possibly due to gym members not returning or shifting to online platforms, permanent gym closures, etc.). Mindful movement (yoga, Pilates, etc.) saw a major boost in popularity during the pandemic and has continued to grow rapidly, not only as at-home exercise, but also for stress relief and mental wellness purposes. Consumer spending on sports and active recreation has also grown steadily in recent years, although participation rates are still below their pre-pandemic levels. Supporting sectors (fitness tech, apparel/footwear, and equipment) all exceed their pre-pandemic levels, and fitness technology has been growing at an especially rapid rate.

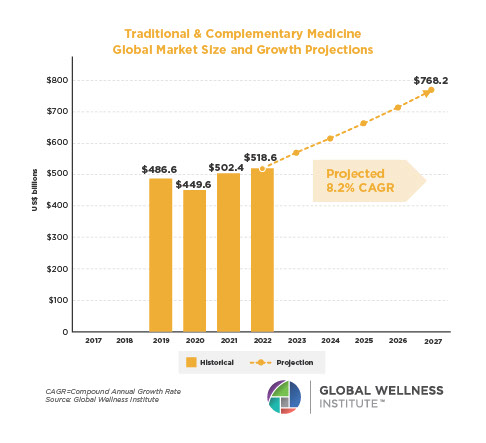

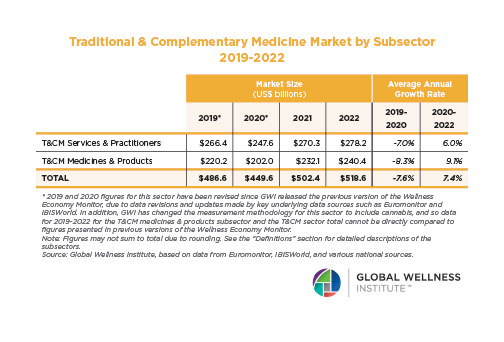

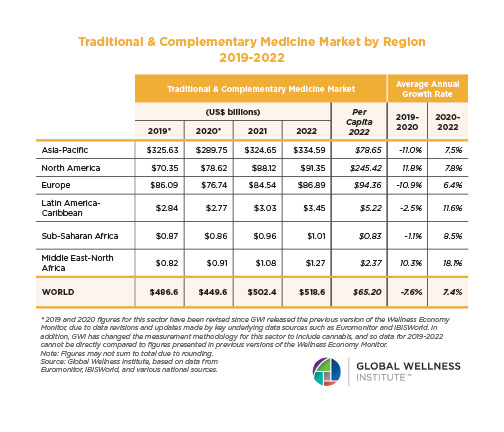

- Traditional & complementary medicine (T&CM) (+3.4% annual growth 2019-2023; now at 114% of its 2019 level) initially declined by 6.4% in 2020 due to business shutdowns disrupting visits to service providers and product manufacturing/sales. The market has rebounded in 2021-2023, and the pandemic has boosted demand for T&CM, as consumers increasingly seek out ways to strengthen their immunity, and fend off sickness, and manage chronic conditions. The rapid rise of the cannabis and CBD market, as regulatory regimes have been loosening in many countries, has especially boosted the growth of this sector.

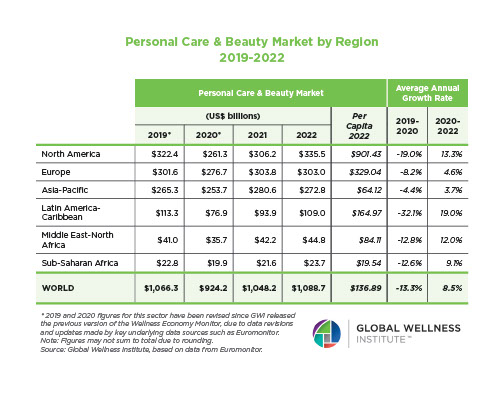

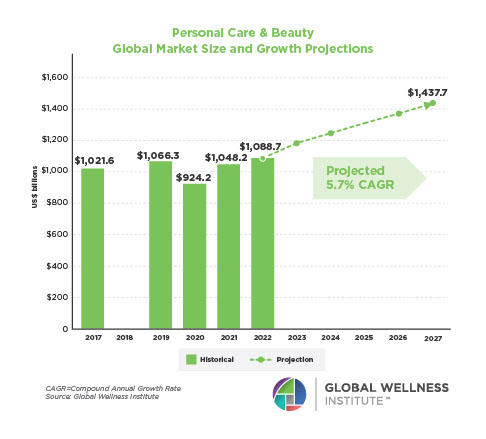

- Personal care & beauty (+3.1% annual growth 2019-2023; now at 113% of its 2019 level) initially shrank by 12.0% in 2020, due to pandemic-related retail disruptions and an overall decline in consumer spending. This sector has recovered quickly in 2021-2023, and it is now 13% above its pre-pandemic level. The growth of personal care & beauty from 2019-2023 (3.1% annual growth) has slightly lagged the growth of overall consumer expenditures during this time period (4.4% annual growth), possibly because several major Asian markets have been affected by currency depreciation, which dampens growth rates in U.S. dollar terms.

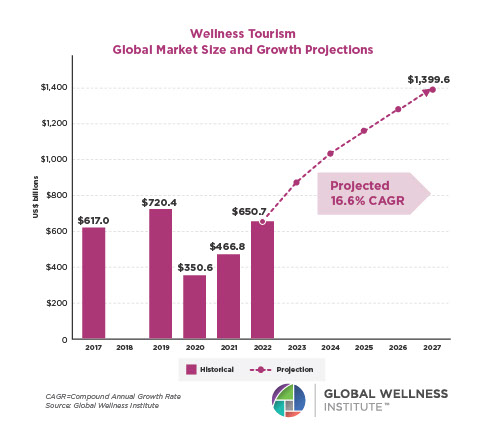

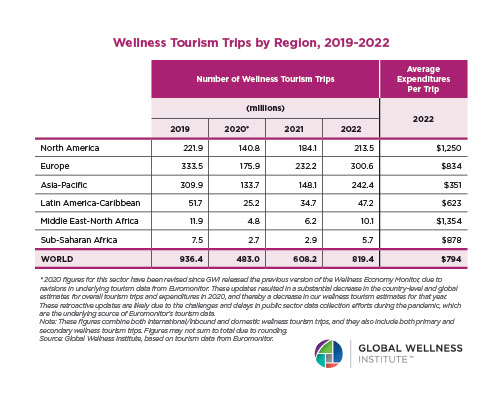

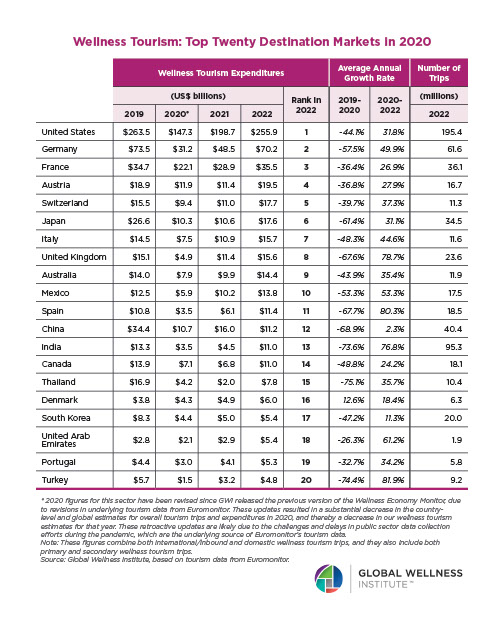

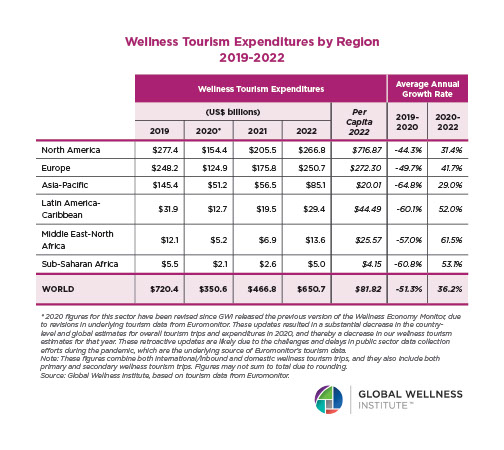

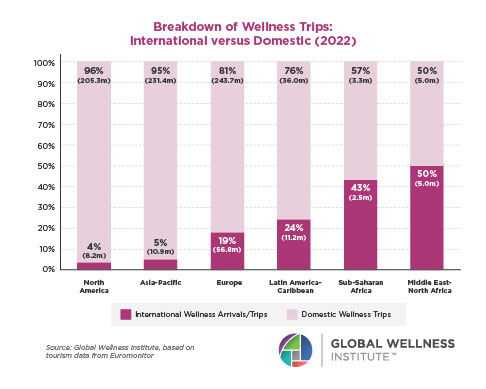

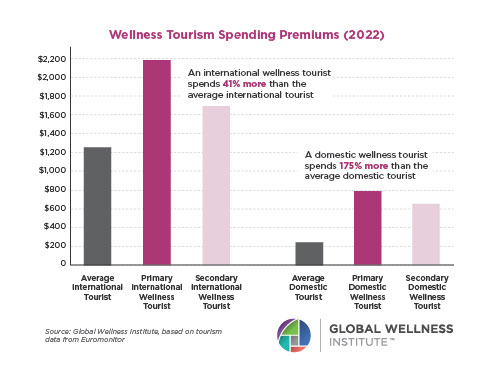

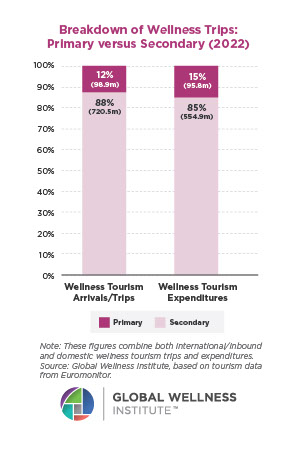

- Wellness tourism (+4.5% annual growth 2019-2023; now at 119% of its 2019 level) was the wellness sector most adversely affect by COVID-19, shrinking by 50.8% in 2020. Its slow recovery was due to the travel bans and border closures around the world, which extended through the end of 2022 in some parts of Asia. Wellness tourism actually fared slightly better than overall tourism during the pandemic, with wellness trips and expenditures falling by less in 2020 and recovering at a faster rate in 2021-2022 as compared to overall tourism. Globally, wellness tourism expenditures have recovered to 119% of their 2019 (pre-pandemic) level, while wellness tourism trips have grown to 111%. By comparison, the recovery rate for all tourism is 101% for expenditures and 90% for trips.

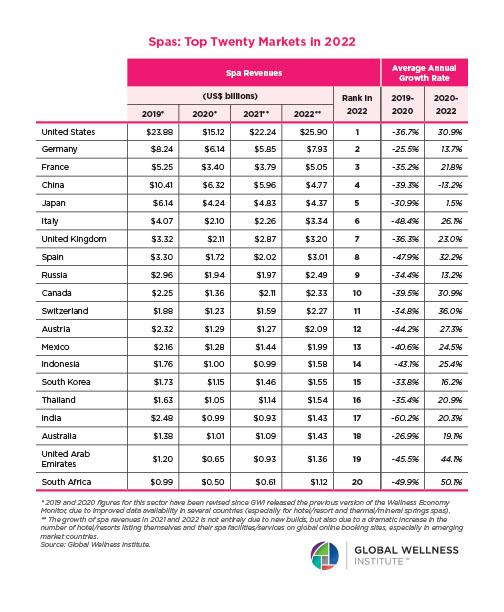

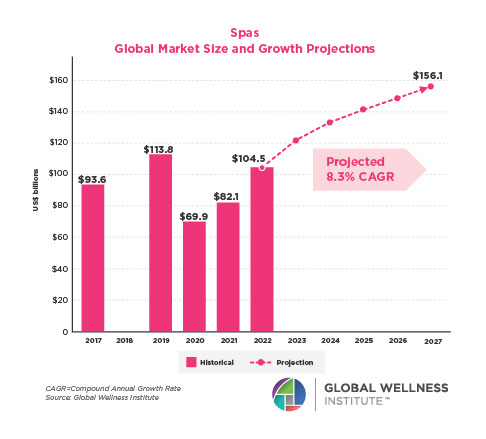

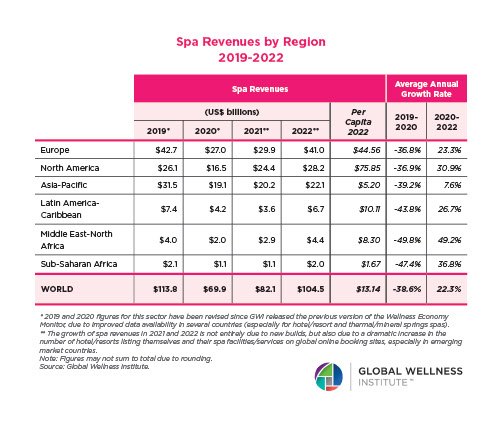

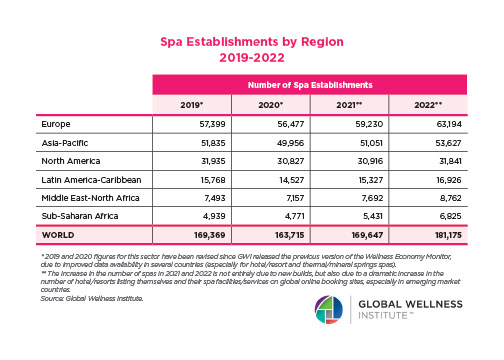

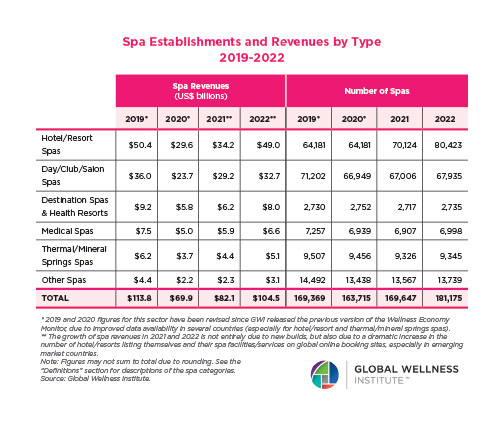

- Spas (+4.1% annual growth 2019-2023; now at 118% of their 2019 level) were hit hard by the early stages of the COVID-19 pandemic, with travel restrictions, business shutdowns, and stay- at-home orders leading to a 38.2% drop in revenues and a loss of over 4,700 businesses in 2020. Virtual offerings are a poor substitute for a physical presence and full immersion in spa experiences. The ongoing pandemic-related restrictions and tourism decline continued to affect many spas around the world throughout 2021 and 2022. Nevertheless, the industry has recovered steadily alongside the recovery of the tourism industry, and spas have posted strong revenue growth rates every year since 2020. As of 2023, global industry revenues have fully recovered and are at 118% of their pre-pandemic level.

Wellness sectors that shrank significantly during the pandemic and have not fully recovered:

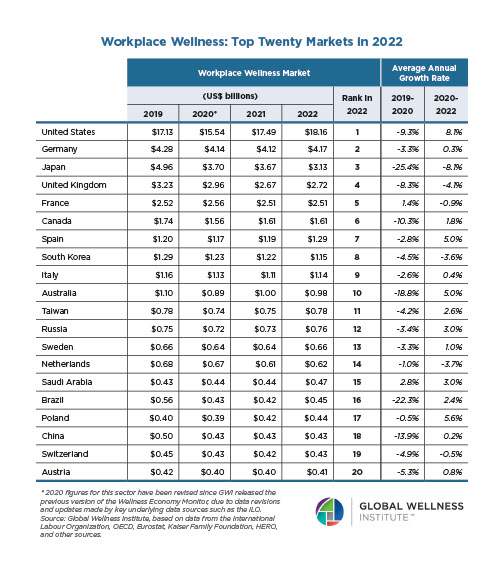

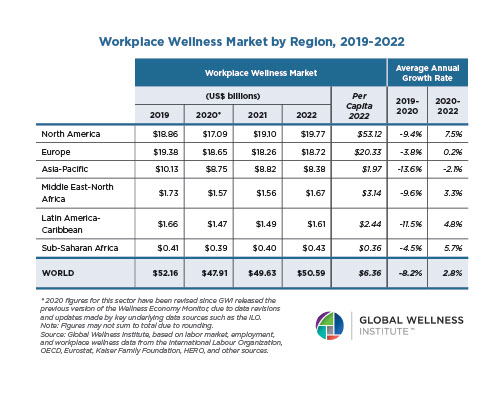

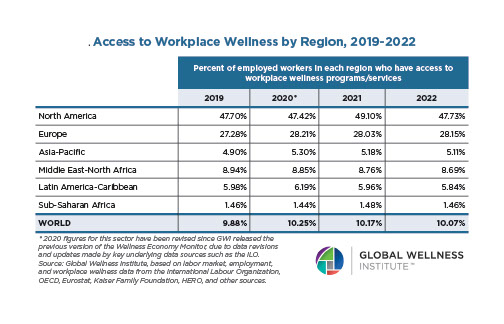

- Workplace wellness (-0.02% annual growth 2019-2023; now at 99.9% of its 2019 level) contracted by 6.6% in 2020, as many of the traditional workplace wellness activities were curtailed during the pandemic amid business shutdowns and shift to remote work. The sector has rebounded in 2021-2023, but it is not quite back to its pre-pandemic level. The market for workplace wellness is primarily driven by underlying labor characteristics across countries, including the share of workers in permanent or wage/salary jobs versus temporary, contract, and gig jobs. As the structure of the global workforce changes, fewer workers are in jobs that have access to workplace wellness benefits. In addition, as employers shift toward more holistic approaches for employee well-being, investments in employee wellness becomes more difficult to quantify (e.g., better air filtration, biophilic elements in workplaces, improved paid leave/benefits, flexible work schedules, changes to work culture, etc.). In addition, currency fluctuations affect our estimates of workplace wellness spending expressed in U.S. dollar terms. This is the case in Europe and Asia-Pacific, where currency depreciation against the U.S. dollar in some large markets has dampened growth and has prevented a return to pre- pandemic levels when measured in U.S dollars (e.g., Germany, Russia, Japan, South Korea).

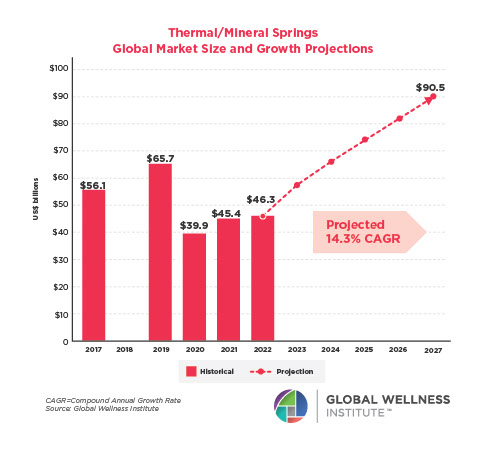

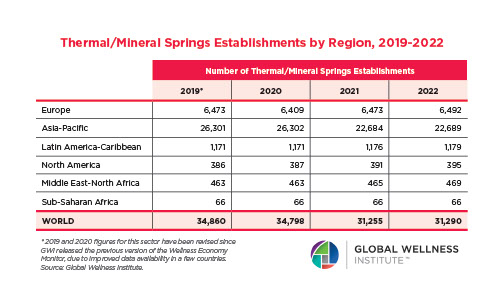

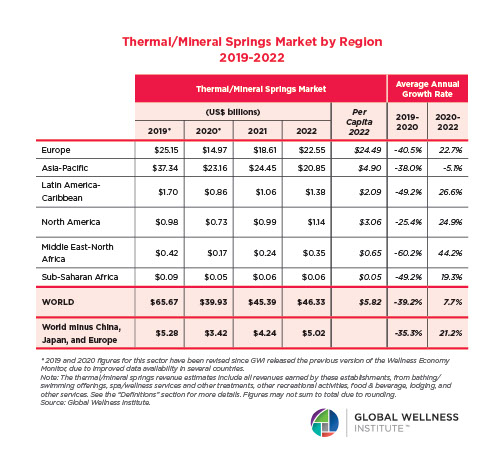

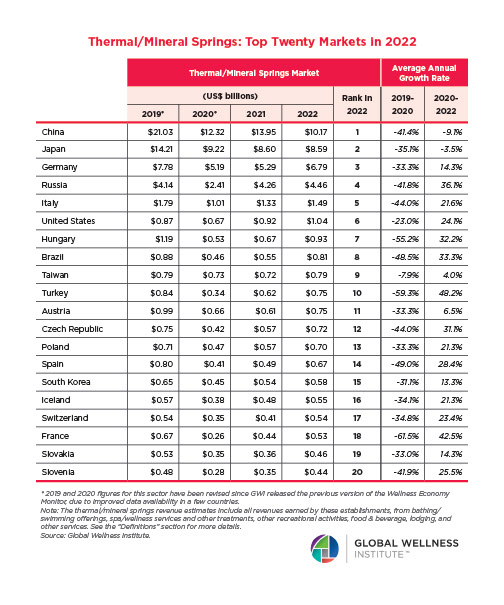

- Thermal/mineral springs (-1.2% annual growth 2019-2023; now at 95.4% of its 2019 level) fell by 40.3% in 2020. The sustained border closures, partial business shutdowns, and capacity restrictions effectively decimated business revenues across many regions in 2020-2021 and kept visitors from fully returning to springs businesses across many countries through 2022. The lack of full recovery at the global level is primarily due to the slow recovery of the thermal/mineral springs markets in China and Japan, which account for nearly half of all global revenues. The slow tourism recovery and weak economic conditions have kept China’s market from returning to pre-pandemic levels; the Japan market has also been affected by currency depreciation against the U.S. dollar, which dampens its growth/recovery rates when measured in dollar terms. In Europe, springs businesses have been negatively impacted by the Ukraine war, energy prices, and staffing shortages. In contrast, across North America, the rest of Asia-Pacific, and Latin America, the thermal/mineral springs market has been booming; in these regions, revenues have grown at a robust 5.5% annually since 2019, and business has rebounded to 124% of pre-pandemic levels.